This move will enable Access Bank to expand its operations in Europe, strengthen its international presence, and deepen its relationships with global clients

LAGOS, Nigeria, May 17, 2023/APO Group/ —

As part of its strategic moves to boost trade and investment between Africa and Europe, Access Bank Plc (www.AccessBankPLC.com), one of Nigeria’s biggest financial services institutions, has established a new subsidiary in Paris, France.

With this bold move, the leading Nigerian financial institution has reinforced its commitment to strengthening cross-border trade and investment between Africa and the world, connecting businesses to opportunities within the continent as Africa’s gateway to the world.

Pan-African and Global Expansion

The launch of Access Bank’s Paris subsidiary marks a significant milestone in the bank’s global expansion strategy. This move will enable Access Bank to expand its operations in Europe, strengthen its international presence, and deepen its relationships with global clients while serving as a hub for supporting the bank’s growing trade finance business in Africa. It will also enable Access Bank to provide seamless banking services to its clients doing business in France and Europe.

With a population of over 67 million people and a GDP of €2.4 trillion, France is a key player in the global economy. Access Bank’s new subsidiary will enable the bank to tap into the country’s vast business opportunities, particularly in the area of cross-border trade finance.

The subsidiary’s location in Paris is strategic, as it is the commercial and financial center of France with a vibrant ecosystem of businesses and institutions. This positioning will allow Access Bank to leverage its local expertise and extensive network to provide tailored solutions to its clients.

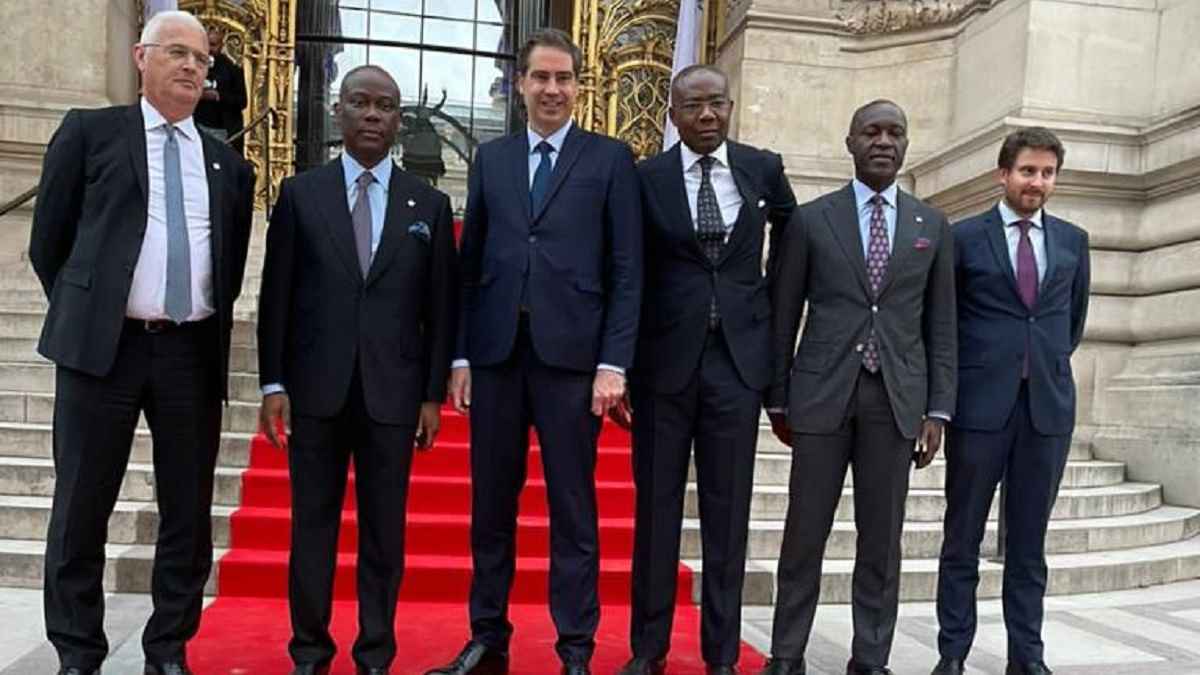

In his remarks at the launch event, the Group Chief Executive Officer of Access Holdings Plc, the parent company of Access Bank, Herbert Wigwe, noted that “the establishment of Access Bank Paris is in line with the bank’s long-term strategy of becoming Africa’s gateway to the world. He also expressed confidence that the new subsidiary will play a key role in driving trade and investment flows between Africa and France”.

Wigwe, while speaking on the purpose of the bank’s strategic expansion efforts, said, “Access Bank Plc, today, has a very strong presence in the United Kingdom, but coming on the heels of Brexit, there was a need for us to establish a presence in another country in Europe, and France provides a very strong platform for us to do so.

“Beyond that, Access Bank has a great presence in the Francophone world that relies significantly—in terms of trade—on France, so Access Bank in Paris will work to support trade possibilities and trade finance solutions to businesses in those regions, ranging from large conglomerates to SMEs and more.

“Our range of banking products and services will be a valuable asset for businesses looking to trade internationally, while our corporate and investment banking services will help businesses access capital, manage their cash flow, and mitigate risk. “Furthermore, we are confident that the Bank’s trade finance solutions will help businesses to navigate the complexities of cross-border trade, and at the same time, our digital capabilities will make banking more convenient and efficient for all our customers,” he reiterated.

The subsidiary’s location in Paris is strategic, as it is the commercial and financial center of France with a vibrant ecosystem of businesses and institutions

He also acknowledged the role of the bank’s various stakeholders in making the expansion drive successful, Wigwe stressed the value of its customers, shareholders, regulators, and the communities it operates.

“Our successes over the years would be footnotes but for the relationships we have fostered with these critical contributors. In recognition of this, we are committed to building long-term partnerships with all our stakeholders in France – based on trust, transparency, and mutual respect,” he added.

It must be noted that Access Holdings, the parent company of Access Bank Plc, has recently announced earnings of N1.38 trillion in the 2022 financial year, making the financial behemoth the first banking institution in Nigeria to hit and cross the N1 trillion mark in gross earnings.

This demonstrates the Bank’s robust risk management, strong credit rating, and high growth potential, as well as the confidence in the bank by its various stakeholders.

With its innovative banking solutions driven by best-in-class technology, customer-centric operations, and its people, Access Bank is on course to achieve its 5-year plan of processing one in every two transactions in Africa and being present in major commercial hubs in the world.

“Access Bank’s presence in France represents an important step towards achieving its goal of bridging worlds and connecting opportunities for African businesses. The bank’s latest stride also lays a marker for realising its recently unveiled 5-year strategic growth plan.

Roosevelt Ogbonna, Managing Director, Access Bank Plc, said at the event, “Over the years, we have demonstrated a strong commitment to deepening the bank’s presence across Africa and beyond.”.

“Today, we are proud to have a presence in 18 countries across four continents, serving millions of customers and businesses. Indeed, our expansion drive has been guided by our vision to become the world’s most respected African bank, and by building on our strong track record of innovation, customer service, and social responsibility, we have come one step closer to achieving this goal.”

“We remain committed to building a bank that is truly global in scope, yet locally relevant in its approach, and we are excited about the opportunities that lie ahead as we continue to grow and expand our footprint in new markets,” Ogbonna added.

Access Bank UK, led by Jamie Simmonds, would oversee the operations of the Paris subsidiary and would effectively become the umbrella company for other representative offices in the country.

Access Bank Paris has already received regulatory approval from the French Prudential Supervision and Resolution Authority (ACPR) and is now fully operational. The subsidiary is staffed with a team of seasoned professionals with deep expertise in the African market and is well-equipped to deliver world-class financial solutions to its clients.

In conclusion, the launch of Access Bank’s Paris subsidiary represents a significant milestone in the bank’s expansion strategy, enabling it to provide seamless banking services to its clients in France and Europe while also promoting cross-border trade finance between Africa and the rest of the world.

Distributed by APO Group on behalf of Access Bank PLC.

Energy4 days ago

Energy4 days ago

Business4 days ago

Business4 days ago

Business4 days ago

Business4 days ago

Energy3 days ago

Energy3 days ago

Business4 days ago

Business4 days ago

Business4 days ago

Business4 days ago

Energy4 days ago

Energy4 days ago

Energy3 days ago

Energy3 days ago