The flagship panel of the Invest in African Energy forum will unpack Africa’s deepwater gas, LNG and FLNG investment prospects and long-term demand growth

PARIS, France, April 29, 2024/APO Group/ —

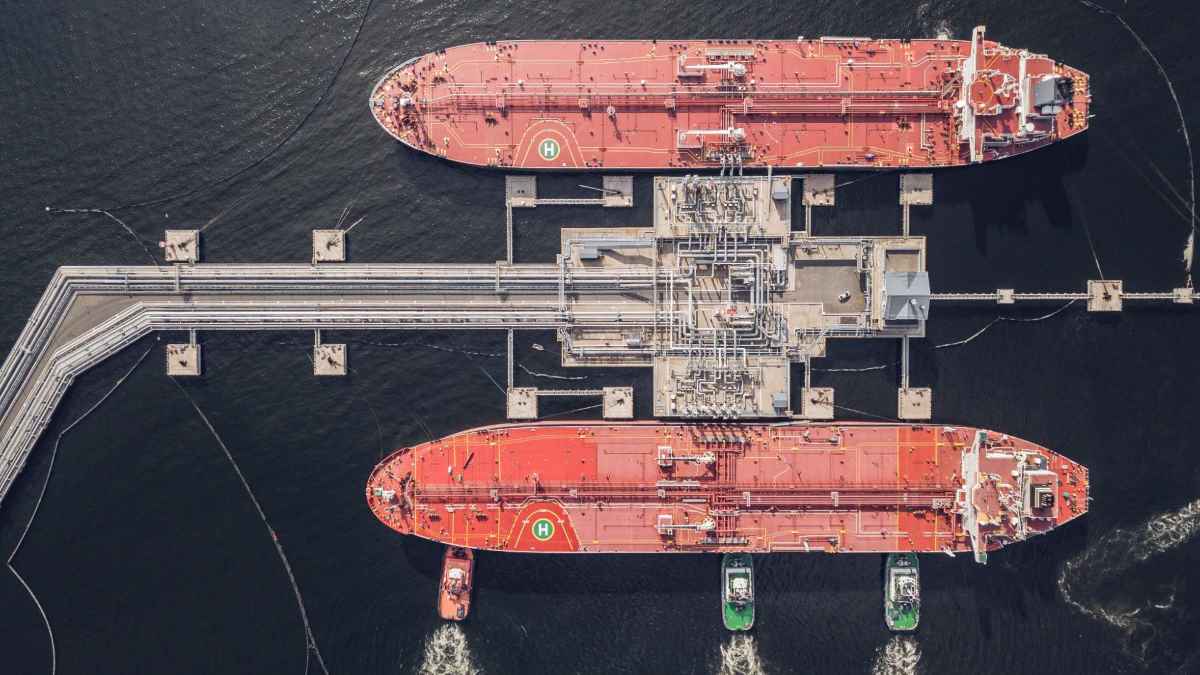

Representing 13% of global reserves, Africa’s gas resources are able to fulfill continent-wide electrification objectives, while accelerating the energy transition and creating diversified downstream industries. The continent currently exports just over 40 million tonnes of LNG per annum, with additional capacity set to come online this year. In a flagship panel at the Invest in African Energy (IAE) forum – taking place in Paris in May 2024 – Africa’s deepwater gas, LNG and FLNG investment opportunities will be further unpacked, as global investors prioritize natural gas as a less carbon-intensive solution still able to deliver energy reliably and to scale.

Under the theme, “Future Proofing Africa’s Gas and LNG Industry,” a dedicated panel will outline Africa’s long-term gas demand growth – among the highest in the world – as well as opportunities to develop, supply and service gas exploration, processing, transport and storage projects. The panel will be moderated by Amena Bakr, Senior Research Analyst, Energy Intelligence and panelists will include Per Magnus Nysveen, Senior Partner & Head of Analysis, Rystad Energy; Armel Simondin, Chief Executive Officer, Perenco and Cobie Loper, Senior Vice President – Operators and Geographical Sales of Energy Equipment, NOV

Organized by Energy Capital & Power, IAE 2024 (https://apo-opa.co/3UMOOtQ) is an exclusive forum designed to facilitate investment between African energy markets and global investors. Taking place May 14-15, 2024 in Paris, the event offers delegates two days of intensive engagement with industry experts, project developers, investors and policymakers. For more information, please visit www.Invest-Africa-Energy.com. To sponsor or participate as a delegate, please contact sales@energycapitalpower.com.

In terms of emerging exporters, countries like Senegal, Mauritania, Tanzania and Mozambique are bringing new capacity online through projects led by bp, Equinor, TotalEnergies and ExxonMobil, while mature markets like Nigeria, Angola and Republic of the Congo are seeking to pivot from crude oil to associated gas production. The panel will explore Africa’s current LNG market outlook, along with the key investment trends shaping global supply-demand dynamics and long-term contract prices.

While the sector is undergoing an $800-billion, 20-year upstream capital expenditure program resulting in several world-class LNG facilities, African gas projects still face a lack of investment, owing in part to high capital requirements, long lead times and above-ground risks. As a result, the panel will explore strategies for governments and regulators to support gas development and stimulate investment through gas-specific legislation. It will also look at how new large-scale gas infrastructure projects can employ innovative solutions, including regional and multilateral financing mechanisms, to secure capital.

Technology will play a key role in discussions, with a focus on enhancing the efficiency, safety and sustainability of LNG operations across the continent. From small-scale LNG that delivers power to off-grid users, to FLNG vessels converted from existing LNG carriers, Africa is home to some of the leading innovations in the sector. Given that LNG is being positioned as a key enabler of the energy transition – emitting 50-60% fewer carbon emissions than oil or coal – the forum targets technology and service providers that can advance the discourse around decarbonization, energy efficiency and environmental stewardship.

Distributed by APO Group on behalf of Energy Capital & Power.