In the US brands are expected to spend an additional $2bn on the Paris Olympics while Euro 2024 will drive €250m in incremental ad spend across Europe – yet the boost will not be enough to reverse TV’s decline

WARC Global Advertising Trends: Sports media in the era of fragmentation

7 February 2024 – At a time when marketers are increasingly reliant on sport for mass reach, the sector faces fragmentation. Live sports rights are splintering between broadcast, over-the-top (OTT or streaming) and mobile apps, while social platforms are rising in importance for fans.

Sports media in the era of fragmentation, WARC Media’s latest Global Advertising Trends report, examines sport’s new media landscape, the challenges and opportunities for brand advertisers and how rights holders plan to sustain the economics of sport in the years ahead.

Alex Brownsell, Head of Content, WARC Media, says: “Sport is one of the last providers of true ‘water cooler moments’, and this year’s bumper schedule of major sporting events, such as the summer Olympics and Paralympics in Paris, the UEFA European Football Championships, and the T20 Cricket World Cup, will provide advertisers with unrivalled means to achieve mass reach.

“However, these enduring qualities are under threat as consumption fragments. In this report we take a closer look at the current state of sport advertising at a time when media consumption poses a dilemma for brand advertisers.”

Key insights highlighted in WARC’s Sports media in the era of fragmentation are:

Major live sport moments still deliver mass audience reach

Over 115 million viewers tuned in across Fox properties to watch Kansas City Chiefs defeat the Philadelphia Eagles in Super Bowl LVII last year making it the most watched US telecast of all time.

TV firms are spending ever greater sums for sports rights

Global spending on sports media rights is forecast to reach $60.9bn in 2024, per SportsBusiness data, up 18.9% on pre pandemic levels, with traditional broadcasters digging deeper to retain access to prime sports assets.

2024 will be a major year for live sport, as the Olympics returns

Broadcasters and streamers will be buoyed by the return of blue chip sports competitions this year, including the Paris 2024 Summer Games, UEFA Euro 2024, and the T20 Cricket World Cup.

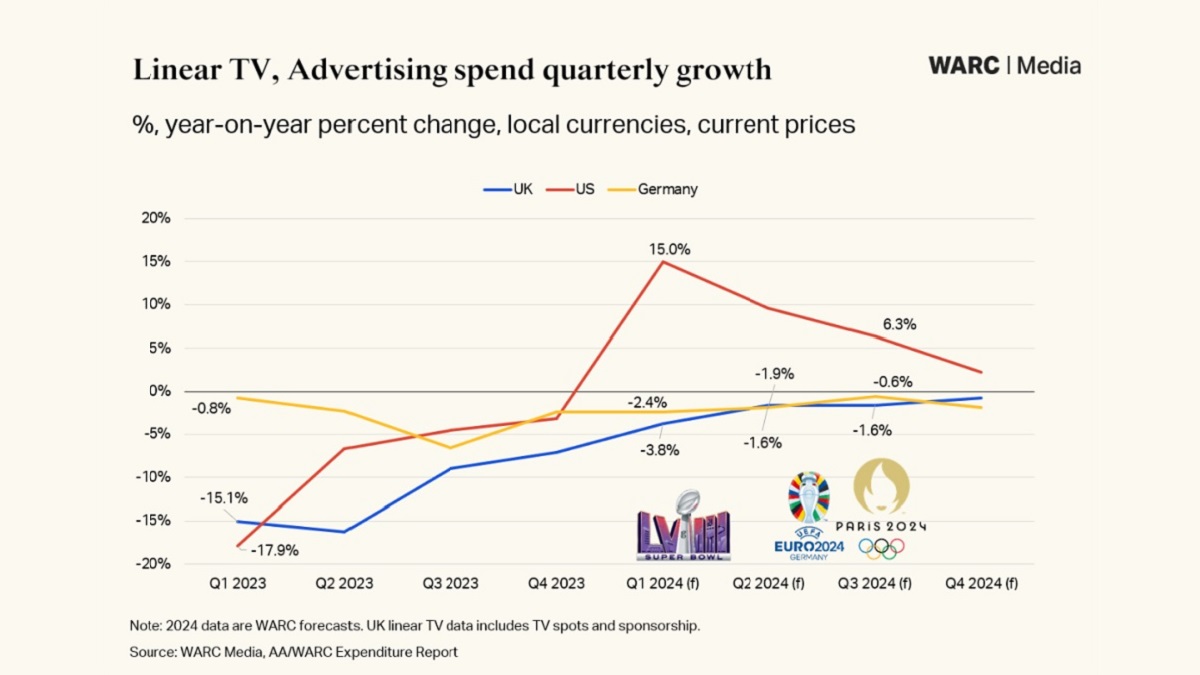

However, sport will not reverse declines in linear TV ad spend

In the UK, spend with linear TV is forecast to remain in decline (-1.6%) throughout the summer of 2024, according to WARC Media data. A similar picture emerges in Germany (-0.6%), which will host Euro 2024, although France bucks the trend (+4.9%). In the US, a recovery of linear TV spend (+6.3%) will owe more to favourable year-on-year comparisons and the upcoming US Presidential election than to sport.

Fragmentation of sports rights threatens mass reach moment

NFL coverage spans broadcast and cable TV (NBC, ESPN) as well as OTT (Peacock, Amazon Prime, YouTube TV) and mobile app (NFL+). It is becoming costlier and more complex for fans to follow all live games.

Social media is taking centre stage as a sports channel

93% of 18-24s engage with sport on social media at least weekly. However, Gen Z fandom is more ‘fluid’. Younger cohorts are often more interested in athletes’ stories, rather than teams or competitions.

Streamers are tapping into a passion for sports stories

Amazon and Netflix are beginning to acquire live sports rights. However, they are also capitalising on a desire for behind the scenes storytelling, with documentary series such as Netflix’s F1: Drive to Survive.

Advertising remains a key part of the Super Bowl experience

Nearly three quarters (73.0%) of those planning to watch Super Bowl LVIII on 11 February intend to watch the commercials. Last year’s broadcast earned Fox an estimated $650m in gross ad revenue, with brands spending up to $7m for a 30 second spot.

Adrian Sutherland, Vice President, Publicis Sports, comments: “Sports is the one constant within media plans. Live sport is getting the eyeballs and sport content is getting the engagement. However, in some sports, local fans may need at least three separate subscriptions to watch a full season of games. It is imperative platforms keep a strong content plan in place to keep consumers engaged.”

Read a complimentary sample report of WARC’s Global Ad Trends: Sports media in the era of fragmentation here, which also includes an exclusive interview with Jérôme Parmentier, VP, Media Rights and Content Partnerships, IOC. A WARC podcast discussing the findings outlined in the report will be available from 20 February.

Global Ad Trends, is a quarterly report which draws on WARC’s dataset of advertising and media intelligence to take a holistic view on current industry developments. It is part of WARC Media, which provides rigorous and accurate benchmarks aggregated and verified from over 100 reputable sources, empowering media decision makers to plan strategies with precision. WARC Media is available by subscription.

Energy4 days ago

Energy4 days ago

Business4 days ago

Business4 days ago

Business4 days ago

Business4 days ago

Energy3 days ago

Energy3 days ago

Business4 days ago

Business4 days ago

Business4 days ago

Business4 days ago

Energy4 days ago

Energy4 days ago

Energy3 days ago

Energy3 days ago