Egyptian businesses keen to increase business and deepen integration with other African countries

CAIRO, Egypt, February 24, 2023/APO Group/ —

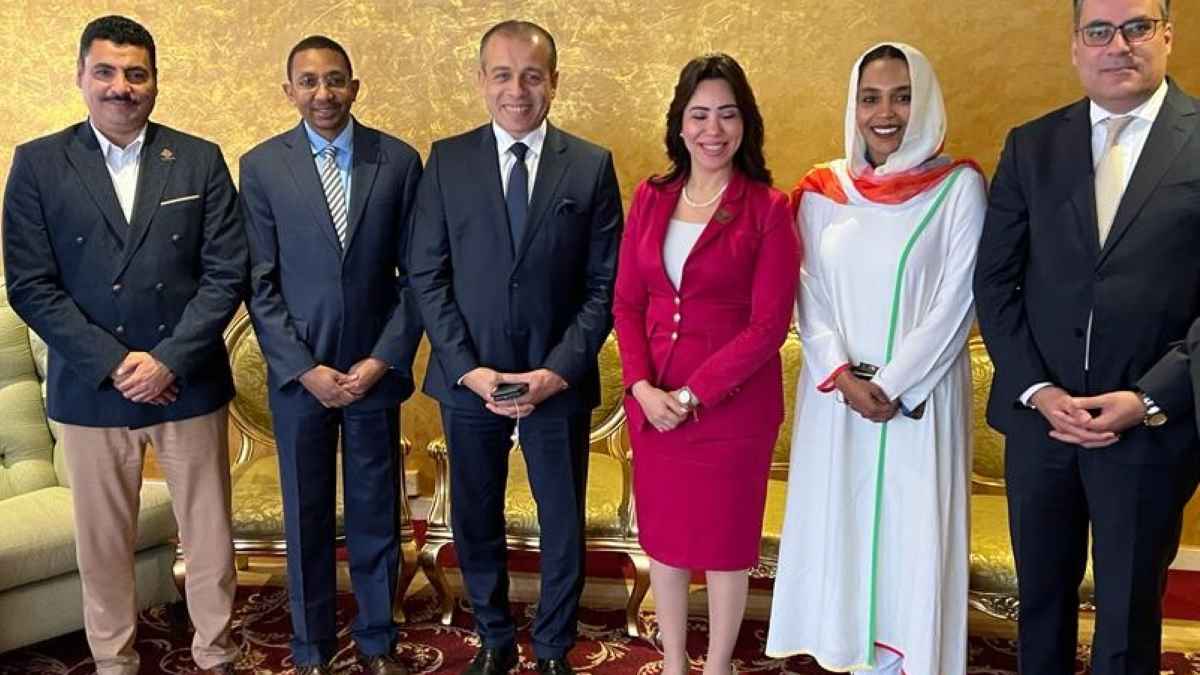

The African Development Bank (www.AfDB.org), in collaboration with the Egyptian Commercial Services (ECS) department of the Egyptian Ministry of Industry and Trade, has ended its first Industrial and Trade Business Opportunity Seminar (IT-BOS) dedicated to establishing business relationships with Egyptian manufacturers and exporters.

The one-day seminar, held on 22 February, saw record attendance from participants who expressed a high-level of interest in strengthening ties with and exploring new business opportunities within Africa.

The meeting brought together industrial, agricultural, and private sector experts from 105 large Egyptian manufacturers and exporters with significant domestic and regional investment activity. The participating companies represented a wide sector of industrial and export councils, namely from the medical, fertilizers, building materials, engineering and chemical industries, mining, food processing and packaging sectors.

Dr. Abdu Mukhtar, African Development Bank Director of Industrial and Trade Department, delivered the opening address on behalf of Solomon Quaynor, Vice President of Private Sector, Infrastructure, and Industrialization.

He highlighted the purpose of the seminar: “to establish solid business relations and explore collaboration opportunities with the Egyptian industrial business community for growth in the domestic market and to deepen Egyptian regional integration in Africa.” He then presented the African Development Bank’s Ten-year strategy, highlighting the “High 5” strategic priorities with a focus on private sector development and job creation.

The meeting brought together industrial, agricultural, and private sector experts from 105 large Egyptian manufacturers and exporters

“African investments in Africa are below acceptable levels, Africa has endless business opportunities that are often unknown to businesses in neighboring countries – a cardinal sin in this information technology age. We should develop a common manual of doing business to facilitate intra-Africa trade we should proactively address the sources of high cost of doing intra-Africa business,” underscored Ambassador, Mohamed El-Badry, Assistant to the Minister for African Affairs.

Dr. Eng. Sherif El Gabaly, Head of the African Affairs Committee in the Egyptian Parliament, applauded the Bank and ECS for organizing the “timely meeting” with the Egyptian private sector. He added that Egypt has a longstanding and deep relationship with the African development Bank Group as a founding member and as the second largest shareholder of the Group, however, the country has so far mainly benefited from the public sector window. He highlighted that Egypt has a strong private sector with cutting edge ideas and talent; and urged the Bank to “support non-sovereign operations which will provide impetus to Egypt’s strategic industrial sectors.”

The seminar was a great opportunity for the companies to proactively share their aspirations, challenges, and opportunities in accessing and growing exports in African markets and exploring potential collaboration areas.

Dr. Yousery El Sharkawy, Chairman Egyptian African Businessmen Association, encouraged Egyptian private sector community to “know the Bank, stay close and knock on the Bank’s door, as it is committed to Egypt’s sustainable growth and a heightened role in Africa’s regional integration.” He added that Egypt has a realistic sense of the ample trade and win-win opportunities with sister African countries, shown by the Country’s leadership’s emphasis on expanding Egypt’s regional alliances.

“This event is the first of its kind, in its focus, timeliness, and the high level of private sector participation from the most strategic Egyptian manufacturers. We want a series of this event to be organized regularly to nurture the business relationship that we have established today,” indicated Dr. Ghada Ali, a member of the Egyptian Parliament Economic Committee.

Yehia El Wathiq Bellah, Minister Plenipotentiary and Head of the Egyptian Commercial Representation stressed that the Bank’s Ten-year strategy is aligned with Egypt’s 2030 Vision which calls for a balanced, knowledge-based and export-based market economy. Hence Egypt should explore opportunities for private sector financing from the African Development Bank, he noted.

Samuel Kamara, Country Program Officer for the Egypt office represented the Bank’s Director General of North Africa, Mohamed El Azizi presented Egypt’s Country Strategy Paper for 2022-2026. Participants also heard presentations on the Bank’s financing instruments and modalities, as well as its private sector engagements in establishing special agro-processing zones in Africa. While the Bank’s footprint is established in twenty member countries, Egypt is yet to access the Bank’s expertise and financing in this sector, they heard.

Following the presentations, the Bank’s team engaged in business-to-business meeting towards the development of a comprehensive pipeline of Egyptian manufacturing and export projects eligible for potential Bank financing. The event was moderated by the Bank’s Principal Industrial Program Coordinator, Dr. Ghada Abuzaid, and Samuel Mugoya, Advisor to the VP Private Sector, Infrastructure & Industrialization.

Distributed by APO Group on behalf of African Development Bank Group (AfDB).

Energy4 days ago

Energy4 days ago

Business4 days ago

Business4 days ago

Business4 days ago

Business4 days ago

Energy3 days ago

Energy3 days ago

Business4 days ago

Business4 days ago

Business4 days ago

Business4 days ago

Energy4 days ago

Energy4 days ago

Energy3 days ago

Energy3 days ago