The Report, titled ‘A Resilient Africa: Delivering Growth in a Turbulent World,’ provides an analysis of the economic environment, trade patterns, debt scenarios, and future projections for African economies

NASSAU, The Bahamas, June 13, 2024/APO Group/ —

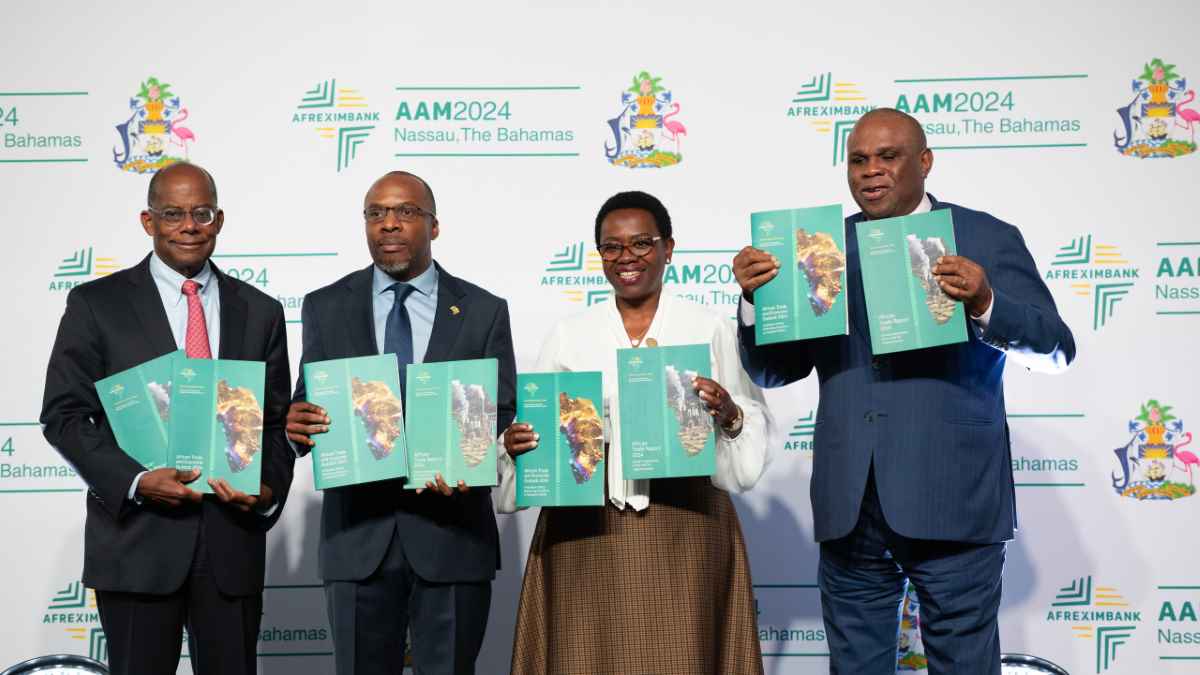

African Export-Import Bank (Afreximbank) (www.Afreximbank.com) today launched its African Trade Report 2024 and African Trade and Economic Outlook Report 2024 at the Afreximbank Annual Meetings (AAM) 2024 in Nassau, The Bahamas.

The latter report forecasts that African economies will grow on average by 3.8% in 2024 – slightly ahead of predicted global growth of 3.2% – prior to increasing by 4% in 2025. The Report, titled ‘A Resilient Africa: Delivering Growth in a Turbulent World,’ provides an analysis of the economic environment, trade patterns, debt scenarios, and future projections for African economies.

Dr. Yemi Kale, Afreximbank’s Group Chief Economist and Managing Director of Research and International Cooperation, said ongoing global challenges undermined the performance of Africa’s trade, which contracted by 6.3% in 2023 after expanding by 15.9% in 2022, while intra-African trade expanded by 3.2% over the same period.

Our analysis in the report also revealed large untapped potential in intra-African trade, especially with respect to machinery, electricity, motor vehicles, and food products

The Chief Economist said: “This performance is reflective of the resilience of the African economy and the potential impact of the African Continental Free Trade Area’s (AfCFTA) single market for the continent as a tool to protect them from global shocks,” adding, “Our analysis in the report also revealed large untapped potential in intra-African trade, especially with respect to machinery, electricity, motor vehicles, and food products.”

The report also revealed that African economies face several downside risks, including increasing levels of sovereign debt and associated sustainability risks, excessive exposure to adverse terms-of-trade shocks, escalating geopolitical tensions in some cases, volatile domestic political environments in certain African countries, high commodity prices and inflationary pressures, and potential food insecurity.

The outlook for the African Continent in 2024 remains positive despite the challenging economic environment of 2023. Most macroeconomic indicators are expected to improve in 2024 and 2025. Growth in the Continent is projected to be higher than the global average, and although inflation is currently high, it is expected to decrease, with this downward trend continuing into 2025.

In the African Trade Report 2024, titled “Climate Implications of the AfCFTA Implementation,” the Chief Economist stated that the report concludes that the AfCFTA offers a path to achieving the developmental goals of African nations while also addressing climate change concerns.

Dr. Kale indicated that while the benefits of the AfCFTA can be seen, the debate on its impact on climate change is still ongoing. He said: “One group believes that increased urbanisation and industrialisation associated with the AfCFTA will worsen carbon emissions, and the second group believes that by emphasising intra-African trade and reducing extra-African trade, carbon emissions will be eliminated through shorter shipping distances.”

Overall, the report states that optimising the AfCFTA can result in potential gains through increased intra-African trade and investment, creating economic prosperity and fulfilling the vision of the founding fathers.

Distributed by APO Group on behalf of Afreximbank.