MOMBASA, Kenya, February 28, 2025/APO Group/ —

- Afreximbank to finance development and operationalisation of industrial parks and special economic zones to bolster industralisation and export manufacturing

- Afreximbank also commits to three-year US$3 billion Kenya country programme to support trade and trade-related investments

African Export-Import Bank (Afreximbank) (www.Afreximbank.com), Africa’s foremost trade development Bank, today in Mombasa, Kenya, ratified a series of initiatives designed to support Kenya’s industrialisation and export-led development agenda. Under the terms of the initiatives, formalised at a signing ceremony with the Kenyan authorities, Afreximbank will finance the development and operationalisation of industrial parks (IPs) and special economic zones (SEZs) to bolster the country’s industrialisation and export manufacturing.

The proposed industrial parks, to be developed by Afreximbank through its affiliate company, Arise Integrated Industrial Platforms (Arise IIP), will create and sustain an environment in which export-oriented industries can thrive, by leveraging economies of scale, shared infrastructure and access to global markets.

Two projects to be undertaken by Afreximbank, with the support of the Government of Kenya and other strategic collaborators, are the development of the Dongo Kundu Integrated Industrial Park and the Naivasha Special Economic Zone II (Naivasha II), for which, having secured leases of the relevant land, Afreximbank intends to leverage the expertise and experience of Arise IIP, a special economic zone developer with experience in the development of integrated industrial parks in Africa.

Both the Dongo Kundu Integrated Industrial Park and the Naivasha Special Economic Zone II are included in the Fourth Medium Term Plan (2023-2027) of the Kenyan government’s Vision 2030, entitled “Bottom-Up Economic Transformation Agenda for Inclusive Growth”, reflecting the high priority which state institutions are giving to measures that strengthen, expand and accelerate Kenya’s capacity to export value-added goods within Africa and globally.

Speaking on the signing, the President of the Republic of Kenya, H.E. Dr. William S. Ruto said; “We have a responsibility to steer the country in the right direction, harnessing the immense potential of manufacturing, industrialization, agro-processing, and value addition within Special Economic Zones. The signing of these agreements today marks a significant milestone in Kenya’s development, expanding opportunities to enhance our manufacturing sector and create a more conducive environment for investment. We convene here today to sign an investment – and not a loan – undertaken by people whose faith in this country and its possibilities motivates their decision. This is our country, let’s continue to do whatever it takes to make it an attractive destination for those who want to invest.”

In his own comments, Prof. Benedict Oramah, President and Chairman of the Board of Directors of Afreximbank, said:

“Africa has been heralded as a land of opportunity, blessed with resources that power the world. Yet, we have struggled to translate this wealth into lasting prosperity for our people. For decades, we have watched as others reap the rewards of our natural resources, leaving us tethered to a cycle of dependency—exchanging our riches for aid and loans that kept us on the fringes of the global breadbasket.

We convene here today to sign an investment – and not a loan – undertaken by people whose faith in this country and its possibilities motivates their decision

“Those days are behind us. Today, Kenya takes a bold step to reshape this story in a profound and impactful manner. These Parks are an integral part of the Government’s plan to boost the country’s economic growth under the Vision 2030 development blueprint.

Today’s signatures are more than ink on paper—they are a promise to the people of Kenya, a pledge that the country will rise as a beacon of industrial might and self-reliance.”

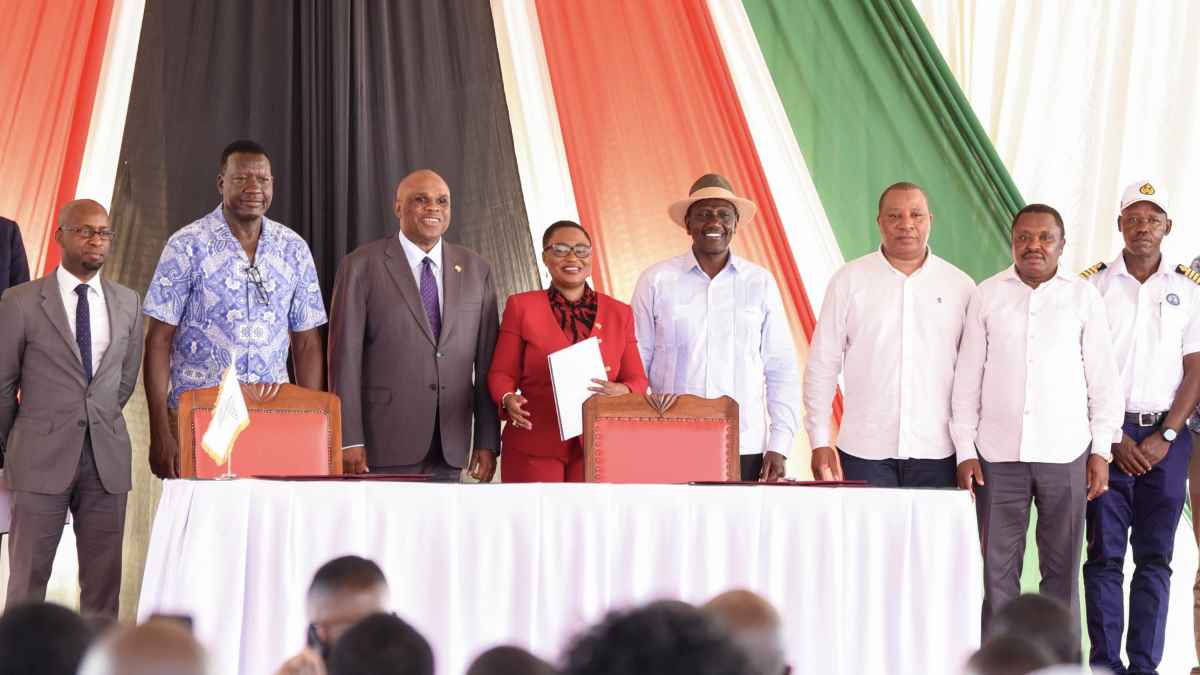

Mrs. Oluranti Doherty, Managing Director of Export Development at Afreximbank, and Captain William K. Ruto, Managing Director of the Kenya Ports Authority, signed the Dongo Kundu Special Economic Zone agreement. Dr. Kenneth Chelule, Chief Executive Officer of the Special Economic Zones Authority, and Mrs. Doherty signed the Naivasha Special Economic Zone agreement, with H.E. Dr. William Ruto, President of the Republic of Kenya, and Prof. Benedict Oramah, President and Chairman of the Board of Directors of Afreximbank, witnessing the signing of both agreements for the State and for the Bank, respectively.

The Dongo Kundu Industrial Park within the Mombasa SEZ is expected, upon completion, to boost the area with a state-of-the-art industrial park that will contribute significantly to economic growth and industrialisation efforts in Mombasa County and in Kenya as a whole.

The Naivasha II Special Economic Zone – Naivasha II project is located at Mai Mahiu and will include a free trade zone, an industrial park, a logistics zone and a public utility area with a supporting road network. The project will occupy an area of approximately 5000 acres.

The Naivasha II project will also derive value from its strategic geographic position as it sits on the gateway to East and Central Africa through the Northern Corridor Transport System, which comprises both a standard gauge railway and a major highway. Moreover, the SEZ will be close to the Naivasha Inland Container Depot, which serves the East African hinterland countries of Burundi, the Democratic Republic of Congo, Kenya, Rwanda, South Sudan and Uganda.

Other dignitaries in attendance included Mrs Oluranti Doherty, Managing Director, Export Development, Afreximbank; Hon. Davis Chirchir E.G.H, Roads and Transport Cabinet Secretary; Hon. Hassan Ali Joho, Cabinet Secretary for Mining, Blue Economy and Maritime Affairs; Hon. Salim Mvurya, Cabinet Secretary for Youth Affairs, Creative Economy and Sports of Kenya and Honourable Lee Kinyanjui, Cabinet Secretary, Ministry of Investment, Trade and Industry. Additionally, Captain William K. Ruto, Managing Director, Kenya Ports Authority; Dr. Kenneth Chelule, Chief Executive Officer, Special Economic Zones Authority; His Excellency Abdulswamad Shariff Nassir, Governor of Mombasa County; the Honourable Benjamin Tayari, Chairman, Kenya Ports Authority, and Mr. Fredrick Muteti, EBS, Chairperson, Special Economic Zones Authority attended the event.

Business4 days ago

Business4 days ago

Business3 days ago

Business3 days ago

Business4 days ago

Business4 days ago

Events3 days ago

Events3 days ago

Business4 days ago

Business4 days ago

Energy3 days ago

Energy3 days ago

Energy2 days ago

Energy2 days ago

Business4 days ago

Business4 days ago