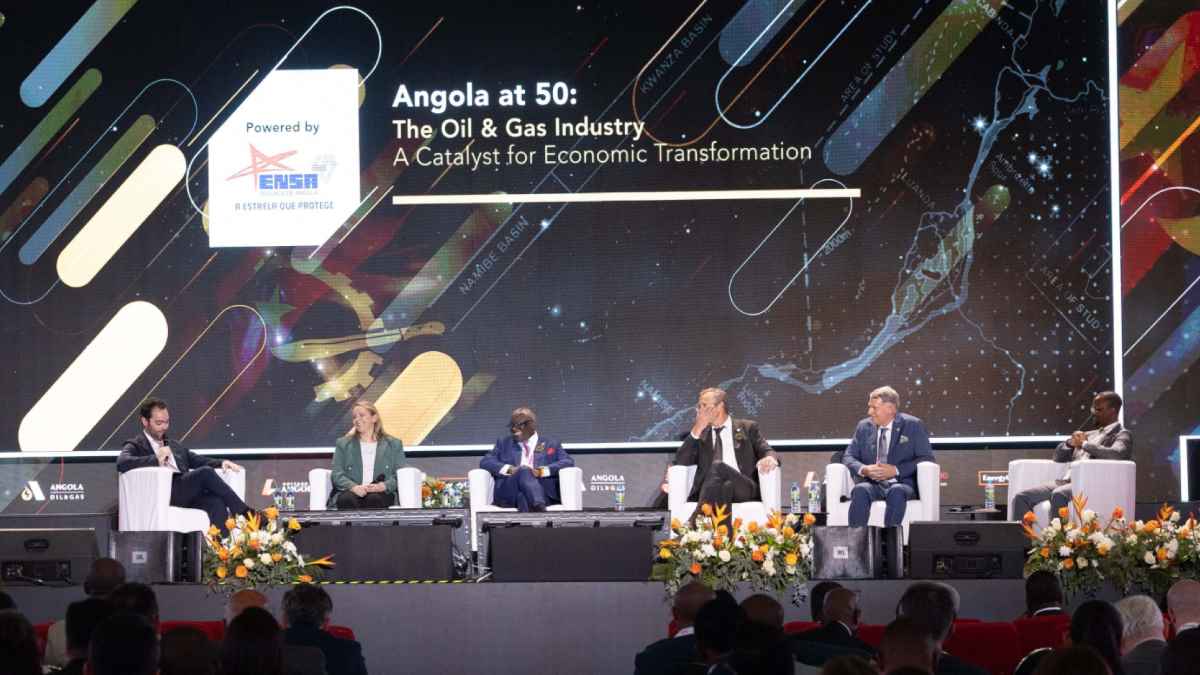

LUANDA, Angola, September 8, 2025/APO Group/ –Leading operators active in Angola reaffirmed their commitment to driving Angola’s next phase of exploration and production during an ENSA-sponsored panel discussion at the Angola Oil & Gas 2025 Conference and Exhibition last week. Representatives from ExxonMobil, TotalEnergies, Chevron, Sonangol and Cabship highlighted how the last 50 years of industry success has laid the foundation for Angola’s next phase of growth.

With a proven track record in delivering major offshore projects in Angola, ExxonMobil continues to invest heavily in exploration projects in the country. The company has made forays into frontier basins such as Namibe and is also reinvesting in producing assets with a view to maximize resources.

“ExxonMobil has produced more than 2.5 billion barrels and developed a capable workforce of over 200 people. After 30 plus years, we are still committed to many more years in Angola. ExxonMobil signed a license extension for Block 15 in 2025. These extensions enable further exploration. We also invested in Namibe last year, which is still an evaluation in progress,” stated Katrina Fisher, Country Manager, ExxonMobil Angola

With a rich history in Angola, TotalEnergies also reaffirmed its commitment investing in Angola’s oil future. The company enhanced its production capacity in Angola in 2025, with two major projects adding 60,000 bpd to the market. Looking ahead, the company will continue to bolster production, leveraging its history to deliver new projects.

Angola has not only progressed in developing and producing offshore projects but made the [global] oil and gas industry progress

“Angola has not only progressed in developing and producing offshore projects but made the [global] oil and gas industry progress. TotalEnergies has accompanied the country through this move with a pioneering spirit. I am sure that this will continue,” stated Martin Deffontaines, Country Manager, TotalEnergies E&P Angola.

Meanwhile, Sonangol continues to advance onshore and offshore developments, seeking to support national production goals while consolidating its position as an upstream driver.

Edson Pongolola, Director of Planning & Management Control, Sonangol, stated that “As a company, Sonangol – built by the government – has a mission to drive the goals of Angola. Sonangol has been growing and is exposing itself to various sectors across the country. Using Sonangol as a vehicle for the growth of other sectors in Angola, the government has been promoting economic development.”

For Chevron, a strategic focus for the company’s future investments in Angola is natural gas. The company has been at the forefront of Angola’s natural gas development strategy, with offshore projects providing vital feedstock for the country’s Angola LNG project.

According to Frank Cassulo, Managing Director, Southern Africa Strategic Business Unit, Chevron, “We continue to think of a future where gas can help us transition and grow the economy. Angola LNG is almost at maximum capacity and we continue to look at opportunities to deliver that gas reliably.”

Celebrating 16 years of operations in 2025, Cabship continues to strengthen Angola’s logistics sector with a view to support upstream and downstream projects. The company has expanded its infrastructure portfolio in recent years, secured contracts with major operators and is working to introduce an offshore diving and offshore support company in the Cabinda Special Economic Zone.

João Filipe, Chairman & CEO of Cabship, highlighted the company’s capacity as a strong local partner for operators. He said: “We manage oil and gas units in Malongo. From this base, we expanded in Soyo and we also came to Luanda where we do work for SONILS and Azule Energy. Last week, we signed a new contract with Angola LNG. We have been trying to give value to the logistics ecosystem. We want to build strong relationships.”

Energy3 days ago

Energy3 days ago

Business3 days ago

Business3 days ago

Business3 days ago

Business3 days ago

Energy2 days ago

Energy2 days ago

Business3 days ago

Business3 days ago

Energy2 days ago

Energy2 days ago

Energy3 days ago

Energy3 days ago

Business3 days ago

Business3 days ago