The financing, approved by Afreximbank in two tranches, supports BUA’s medium-term objectives by unlocking capital to pursue emerging market opportunities

LAGOS, Nigeria, November 12, 2024/APO Group/ —

Africa Finance Corporation (AFC) (www.AfricaFC.org), the continent’s leading infrastructure solutions provider, has facilitated a landmark US$200 million corporate finance facility for the BUA Group, a prominent Nigerian conglomerate spanning food, infrastructure, mining and manufacturing sectors. The facility, provided to BUA Industries Limited by the African Export-Import Bank (Afreximbank), marks the second successful financial advisory mandate that AFC has closed for the BUA Group (BUA), reaffirming its commitment to driving impactful transactions that advance sustainable development and economic growth across Africa.

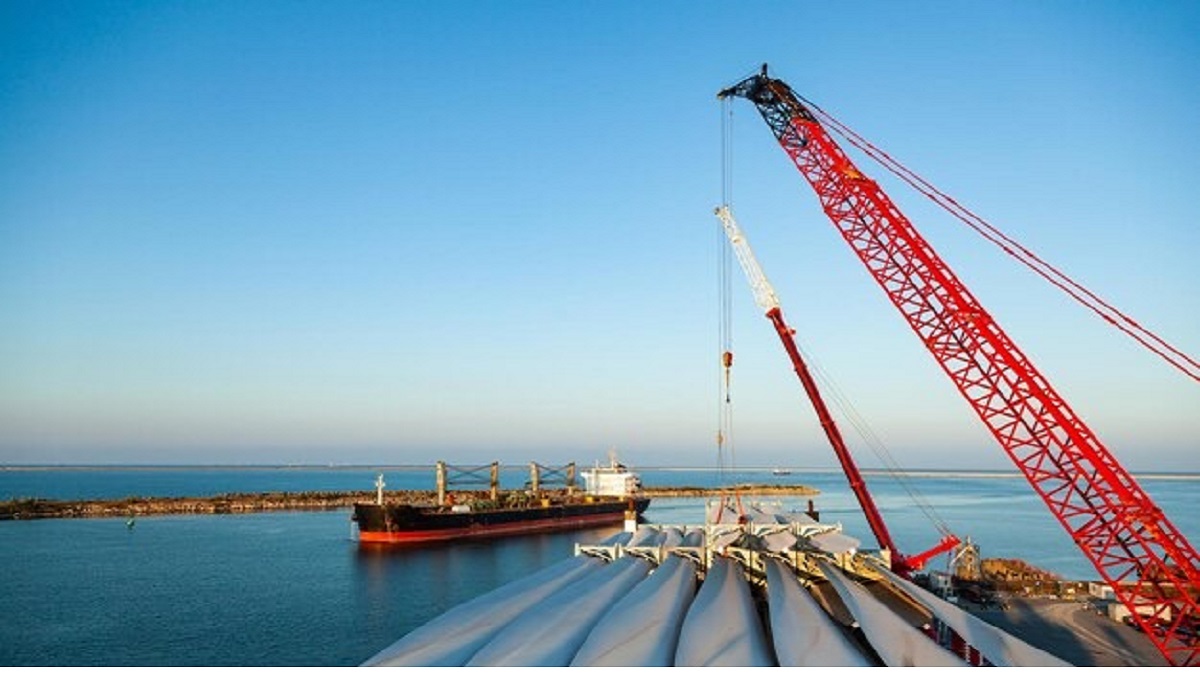

The financing, approved by Afreximbank in two tranches, supports BUA’s medium-term objectives by unlocking capital to pursue emerging market opportunities. The first tranche of US$150 million has been disbursed, enabling BUA to accelerate growth initiatives across its diverse portfolio, which includes sugar and cement production, flour milling, oil processing, real estate development, oil and gas, shipping and ports.

AFC’s partnership with BUA has been integral to several key projects, including its advisory role in the financing of BUA’s 20,000 hectares integrated sugarcane plantation and sugar production facility in Kwara State in 2021. This project is helping to significantly reduce Nigeria’s dependency on imported sugar raw materials while fostering job creation and stimulating economic activity.

We are proud to have played a central role for BUA in their continued expansion, driving local manufacturing, job creation and economic prosperity in Nigeria and Africa as a whole

Group Executive Director at BUA Industries Limited, Kabiru Rabiu said: “We are pleased to conclude the successful raise of the loan facility with Afreximbank. This partnership underscores the confidence that leading financial institutions, like AFC and Afreximbank, have in BUA Group’s growth strategy. The funding not only validates our strong growth prospects but also positions us to better capitalize on emerging opportunities.

We would like to express our gratitude to all the advisers involved in this transaction, including AFC, PAC Capital Limited (PAC), A&O Shearman and G. Elias, whose dedication and expertise were instrumental in structuring agreeable terms for a successful raise. This facility will enable us to pursue opportunities that are vital to the continued economic development of Nigeria and Africa as a whole, and that is a win for the entire nation and continent.”

Executive Director and Head of Financial Services at AFC, Banji Fehintola said: “The success of this transaction reflects the strength of AFC’s financial advisory expertise in providing top-tier strategic, corporate finance and technical guidance to leading institutions across Africa. We are proud to have played a central role for BUA in their continued expansion, driving local manufacturing, job creation and economic prosperity in Nigeria and Africa as a whole.”

In addition to advising on the BUA transaction, AFC has supported a diverse range of high-impact projects on the continent in recent years. This includes advising FGN Power Company Limited, the Nigerian government’s implementation vehicle for the Presidential Power Initiative (PPI), focused on improving power infrastructure in the country, and providing strategic guidance to the International Finance Corporation (IFC) and the Nigerian Sovereign Investment Authority (NSIA) in developing sustainable, climate-positive financing solutions for Nigeria’s electricity distribution sector. Last year, AFC provided advisory services for 24 projects totalling over US$18 billion in value.

Distributed by APO Group on behalf of Africa Finance Corporation (AFC).

Energy4 days ago

Energy4 days ago

Business4 days ago

Business4 days ago

Business4 days ago

Business4 days ago

Energy3 days ago

Energy3 days ago

Business4 days ago

Business4 days ago

Business4 days ago

Business4 days ago

Energy4 days ago

Energy4 days ago

Energy3 days ago

Energy3 days ago