Together with Alex Morgan, Tatjana Smith, Linda Motlhalo, Douglas Matera, and Team Powerade, Brand is Elevating Athlete Partnerships & Focusing on Meaningful Athlete Support

JOHANNESBURG, South Africa, December 6, 2024/APO Group/ —

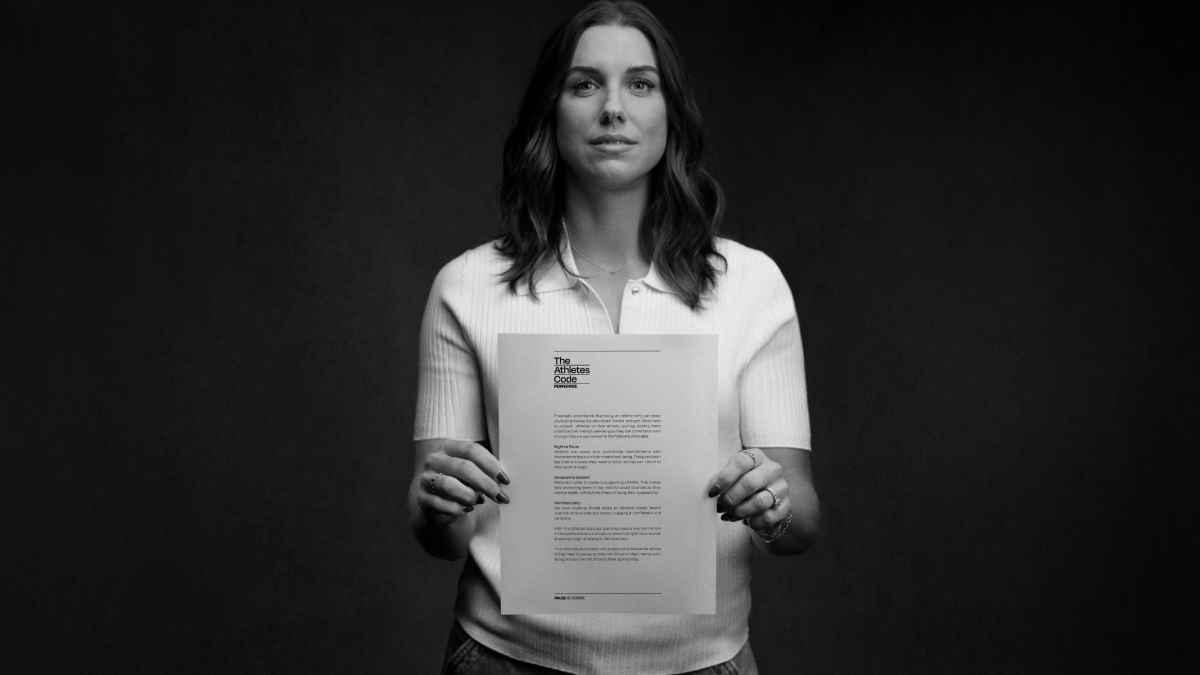

POWERADE (www.POWERADE.com) today announced The Athletes Code, a commitment to a more inclusive and progressive relationship with athlete partners to support their mental well-being. Launching in partnership with Olympic Gold Medalist and World Cup Champion Alex Morgan, Olympic gold medalist swimmer Tatjana Smith, South African footballer Linda Motlhalo, and Brazilian Paralympic swimmer Douglas Matera, The Athletes Code is a contractual provision that allows athletes to pause their partnership commitments to focus on their mental well-being, without losing their sponsorship.

The Athletes Code launches at a time when athletes are under immense pressure to perform, often at the cost of their mental health, as stepping away to address these needs could risk their sponsorships. This new contractual protection developed by POWERADE provides athletes with the time and space they need to care for their mental health, and most notably, ensures the continuation of their sponsorship with POWERADE.

Inspired by athletes and their courage to speak up openly about such an important topic, The Athletes Code underscores POWERADE’s core values of inclusion and dedication to fully protecting their athletes who need to pause their partnership commitments to support their mental wellbeing.

The Athletes Code launches with support from Team Powerade, a global roster of international athletes who represent the embodiment of strength, resilience and dedication.

Alex Morgan, Tatjana Smith, Linda Motlhalo, and Douglas Matera bring The Athletes Code to life through powerful storytelling that captures their firsthand experience with navigating the intense pressures of unrelenting performance demands and the impact it can have on mental health. In addition to sharing their personal stories, these athletes reflect on the role of mental health support in sports, their appreciation for sponsors who champion athlete well-being, and the meaningful change they believe The Athletes Code will create for current and future partners.

“POWERADE’S new commitment creates a platform that gives athletes the peace of mind to know they’ll be supported unconditionally,” said Alex Morgan. “What POWERADE is doing offers a level of support and reassurance to athletes at all stages of their journey, whether they’re an up-and-coming star chasing their dreams or a new mom balancing her sport and motherhood. With the incredible pressures athletes face today, whether student athletes to professionals, I couldn’t be prouder to help create the space for athletes to take the time they need without the fear of consequences.”

Having a partner who cares enough about what you might be experiencing outside of your sport – that’s the type of support that can improve athletes’ lives everywhere

Tatjana Smith added: “I’m so grateful to be a part of The Athletes Code, because I know how much pressure has been put on me in the past and how it has impacted me. This level of protection is something athletes definitely need, and that unwavering support – that is what athletes want.”

Said Linda Motlhalo,“The Athletes Code is an amazing thing. It’s something that fully protects players; it doesn’t focus only on our performance on the field, it also takes into account what we might be facing in our day-to-day lives off the field. Having a partner who cares enough about what you might be experiencing outside of your sport – that’s the type of support that can improve athletes’ lives everywhere.”

“Athletes face immense pressures, both on and off the field,” said Douglas Matera. “Knowing that my sponsor has my back if I ever need to pause is a game-changer. It gives me and so many others the freedom to focus on ourselves when needed.”

Additional Team POWERADE athletes supported by The Athletes Code include Alberto Abarza (Chile), CJ Bott (New Zealand), Dmitrij Ovtcharov (Germany), Emma Twigg (New Zealand), Florian Jouanny (France), Harrie Lavreysen (Netherlands), Ji So-Yun (South Korea), Kaylene Corbett (South Africa), Lydia Williams (Australia), Mathilde Gros (France), and Tyler Wright (Australia).

An extension of POWERADE’s “Pause is Power” platform, The Athletes Code continues to challenge the “win at all costs” mentality and continues the conversation around fully protecting athletes’ wellbeing.

“POWERADE has been a long-time partner to athletes around the world, supporting their journeys on and off the field,” said Matrona Filippou, President, Global Hydration, Sports & Tea. “Following the Olympic and Paralympic Games, we recognized the opportunity to be a stronger ally to our athlete partners. We believe that true strength comes from knowing when to pause to comeback stronger, and we’re proud to encourage this belief by formally giving them the ability in their contracts to prioritize their mental health. We look forward to continuing to support athletes at every stage of their journey.”

POWERADE’s “Pause is Power” platform, which first debuted in 2022, defines pausing as the key to powering and prioritizing life over winning. Now in the brand’s third year of this journey, POWERADE consistently advocates the “Pause is Power” narrative through creative campaigns and community-level activations that inspire passionate people around the world to experience the power in pause.

The Athletes Code was created by WPP Open X, led by Ogilvy and supported by Burson, EssenceMediaCom, Hogarth and VML. The hero film and supporting creative was developed by Ogilvy New York, and directed by Let It Rip Pictures director Babak Khoshnoud.

For more information, visit https://apo-opa.co/49qP2Mv.

Distributed by APO Group on behalf of POWERADE.

Business4 days ago

Business4 days ago

Business5 days ago

Business5 days ago

Events4 days ago

Events4 days ago

Energy3 days ago

Energy3 days ago

Energy4 days ago

Energy4 days ago

Events4 days ago

Events4 days ago

Business3 days ago

Business3 days ago

Business5 days ago

Business5 days ago