Ahead of African Energy Week 2023, the Invest in African Energy Forum in Paris featured a discussion on the changing relationship between African energy producers and global stakeholders triggered by new focus on local content

PARIS, France, June 2, 2023/APO Group/ —

Since early discoveries of oil and gas in Africa, European investors and project developers have been instrumental in driving project developments, providing capital, technology and expertise and working closely with governments to monetize resources. Now, shifts in dynamics are seeing global stakeholders playing a much larger role in Africa, transitioning from energy players to partners as local content becomes a top priority continent-wide.

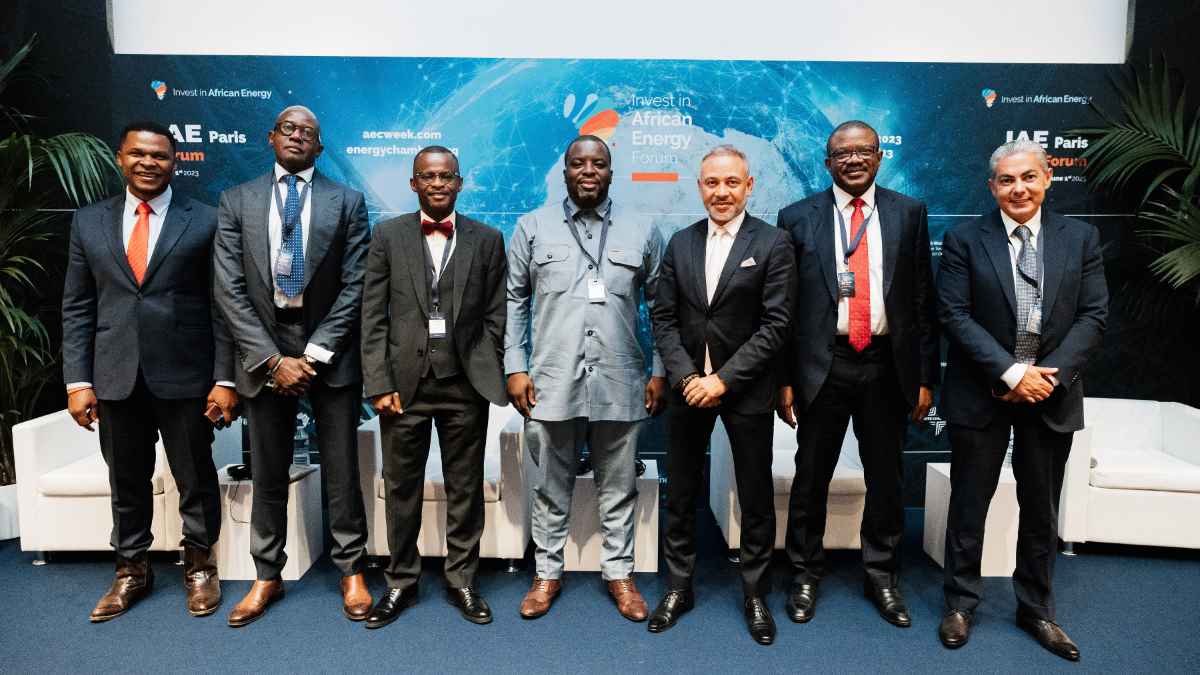

At the Invest in African Energy Forum in Paris this week – representing a preliminary networking forum to African Energy Week (AEW) 2023, scheduled for 16-20 October in Cape Town – the discussion on local content saw new ideas being generated, as speakers emphasized the role joint ventures play in strengthening Africa’s energy industry.

Speakers included Mohamed Fouad, Founder & Managing Director, Egypt Oil & Gas and Secretary General, Egyptian Gas Association; Franck Pliya, Senegal Country Director & Mauritania Branch Representative – Vice President Business Development West/Central Africa, Technip Energies; Florival Mucave, Executive Chairman of the Mozambique Oil & Gas Chamber; David Pappoe jnr, President, African Energy Chamber Ghana; and Viannet Okume, Administrator Director General, Vaalco Gabon SA.

Opening the discussion on local content in Africa, Mucave stated that, “We are not talking local ownership. What we are saying is that the investment you make in education and skills transfer represent part of the local content conditions for companies in a country.”

What we are saying is that the investment you make in education and skills transfer represent part of the local content conditions for companies in a country

Across the continent, governments have begun to implement local content policies that ensure energy investments translate into tangible opportunities for local communities and businesses. According to Okume, “The government has a responsibility and it is included in hydrocarbon law.”

Pliya reiterated this notion, stating that “what is important is to have the political will by the players and sub-contractors. You can have all the legislation, but if laws are too harsh, investors will be deterred. You have to find the right balance.”

Beyond legislation, Memba highlighted the role training and capacity building plays, stating that while the government needs to have the right laws in place, local players need “opportunities to be part of the game, not just as a local partner.” He added that, “The key is not only to make money, but to train others. If you don’t train people who work with you, it will be dead end.”

According to Pappoe, despite opportunities for local players opening in the energy sector, local companies do not know how to [participate], and they do not have access to finance. Governments need to enforce education in this area.”

Expanding on the role capacity building plays, Fouad stated that, “No sustainable growth will happen without capacity building. Making energy poverty history by 2030 cannot happen without capacity building. If Africa wants to depend on itself, you need to develop the skills.”

Discussions surrounding local content and collaboration will be further unpacked during AEW 2023. Featuring a lineup of speakers from across the African energy value chain as well as investors and project developers from the global sector, the event will unlock a new era of collaboration in Africa underpinned by local content and a rise in joint venture partnerships.

AEW 2023 is the African Energy Chamber’s annual energy event. This year’s edition takes place in Cape Town from October 16-20 under the theme, ‘The African Energy Renaissance: Prioritizing energy poverty, people, the planet, industrialization and free market.’

Distributed by APO Group on behalf of African Energy Chamber.

Energy5 days ago

Energy5 days ago

Business5 days ago

Business5 days ago

Energy3 days ago

Energy3 days ago

Business3 days ago

Business3 days ago

Business3 days ago

Business3 days ago

Energy2 days ago

Energy2 days ago

Business3 days ago

Business3 days ago

Energy2 days ago

Energy2 days ago