The goal of the new initiative is to build a national effort to diagnose and treat many more children

ABIDJAN, Ivory Coast, July 7, 2023/APO Group/ —

Launched by Mitrelli Group, Menomadin Foundation, Save a Child’s Heart, Côte d’Ivoire Health Ministry and Abidjan Institute of Cardiology; Côte d’Ivoire Minister of Health: “Health-independence is a national strategic priority, and this project is a major step on the road to that vital goal.” ; Taking part in the project: Mitrelli’ s health subsidiary Promed International (Switzerland) and the Sylvan Adams Children’s Hospital (Israel), AFCAO and CHU Nantes (France).

The Mitrelli Group (https://Mitrelli.com/), the Menomadin Foundation (https://MenomadinFoundation.com/), Save a Child’s Heart (https://SaveaChildsHeart.org/), and the Côte d’Ivoire Health Ministry, this week announced an innovative local-capacity-building initiative in Côte d’Ivoire to establish the country’s local capabilities in the field of life-saving paediatric cardiac surgery, and enable the country to become a model for self-sufficiency in this field in the continent.

The initiative is rooted in the “UN’s Sustainable Development Goal to promote Good Health and Well Being”.

Approximately 1 in every 100 babies born in the world suffers from congenital heart disease (CHD), which are structural heart anomalies that occur during pregnancy when the heart or major blood vessels fail to develop properly. CHD is the most common type of birth defect, but with advanced medical care and treatment, the chances of infants and children fully recovering from CHD and living normal adult lives are better than ever. However, in countries where the necessary treatments are unavailable, CHD is the leading cause of mortality in the first year of life.

According to the WHO (https://apo-opa.info/3O1Ps2F), 2,700 out of 300,000 births registered each year in Côte d’Ivoire, suffer from congenital heart disease. However, the screening rate for these congenital heart diseases is very low (11%).

The goal of the new initiative is to build a national effort to diagnose and treat many more children, while jointly establishing Côte d’Ivoire’s paediatric cardiac surgery health-independence with advanced medical knowledge and resources.

As part of this new partnership, projected to last for 5 years, the Institut de Cardiologie d’Abidjan’s medical staff will undergo advanced training in various heart-related procedures from French and Israeli cardiology teams, enhancing their existing professional capabilities. Delegations of surgeons will travel throughout the year to Côte d’Ivoire, to perform operations on young patients, and provide training for local medical teams. In addition, medical teams from Côte d’Ivoire will benefit from state-of-the-art training in Israel in different fields of paediatric cardiac care.

The project will serve Côte d’Ivoire as a model and a reference point for paediatric cardiac surgery in Africa

The project will serve Côte d’Ivoire as a model and a reference point for paediatric cardiac surgery in Africa – not only reducing mortality rates but also improving quality of life for children. Meanwhile, the most serious and urgent cases will be transferred for immediate care in Israel.

The announcement of the initiative was made at a special meeting at the Côte d’Ivoire Ministry of Health and included the participation of nine children with heart deficiencies, ranging between the ages of 1 to 13 years old, who are traveling to Israel in the coming days to undergo life-saving heart procedures at the Sylvan Adams Children’s Hospital through Save a Child’s Heart.

In 2020, during the early stages of the project, the foundation, “Children of Africa” under the patronage of First Lady Mrs. Dominique Ouattara, Mitrelli Group, Menomadin Foundation and the NGO “Save a Child’s Heart”, worked together to facilitate successful surgeries in Israel for five children suffering from cardiologic conditions.

Minister of Health of Cote d’Ivoire Mr. Pierre Dimba spoke on the importance of health independence as a strategy of the government. “Patients with heart defects require not only surgery but also post-treatment. Sending children abroad for surgery is a blessing but not a long-term solution. Achieving health-independence in the field of paediatric cardiological care especially, is a national strategic priority, and this project is the first step on the road to that vital goal. Our vision is to stop outsourcing our healthcare, and instead begin to export our own capabilities to help others.”

He added, “We are extremely pleased with the cooperation with our partners and the treatments of our children at the Sylvan Adams Children’s Hospital through Save a Child’s Heart and we are looking forward to establishing this extremely important and strategic health model for our country and happy to see it serve as a model cross-Africa.”

Haim Taib, Founder and President of Mitrelli Group and Menomadin Foundation and President of Save a Child’s Heart Africa said: “This is an incredible opportunity to make a difference in the wellbeing of children and their future through upgrading local capacities and creating sustainable solutions. If 1% of children in the country need heart surgery, philanthropic activity, however blessed, is just a drop in the ocean. In order to create a significant, sustainable and long-term impact, the government must be involved, because only the government has the power to create a long-term solution. This is the Mitrelli model – to build long term sustainable development solutions in cooperation with our local partners in health, agriculture, education, and more, to create real impact. Together with Menomadin’s ability to provide solutions based on national roadmaps and impact management, I am sure that Cote d’Ivoire will be a model for additional countries. We are extremely encouraged by Cote d’Ivoire leadership – the president and health minister – and their commitment to building a self-sufficient model to treat children, and proud to be working with such special partners.”

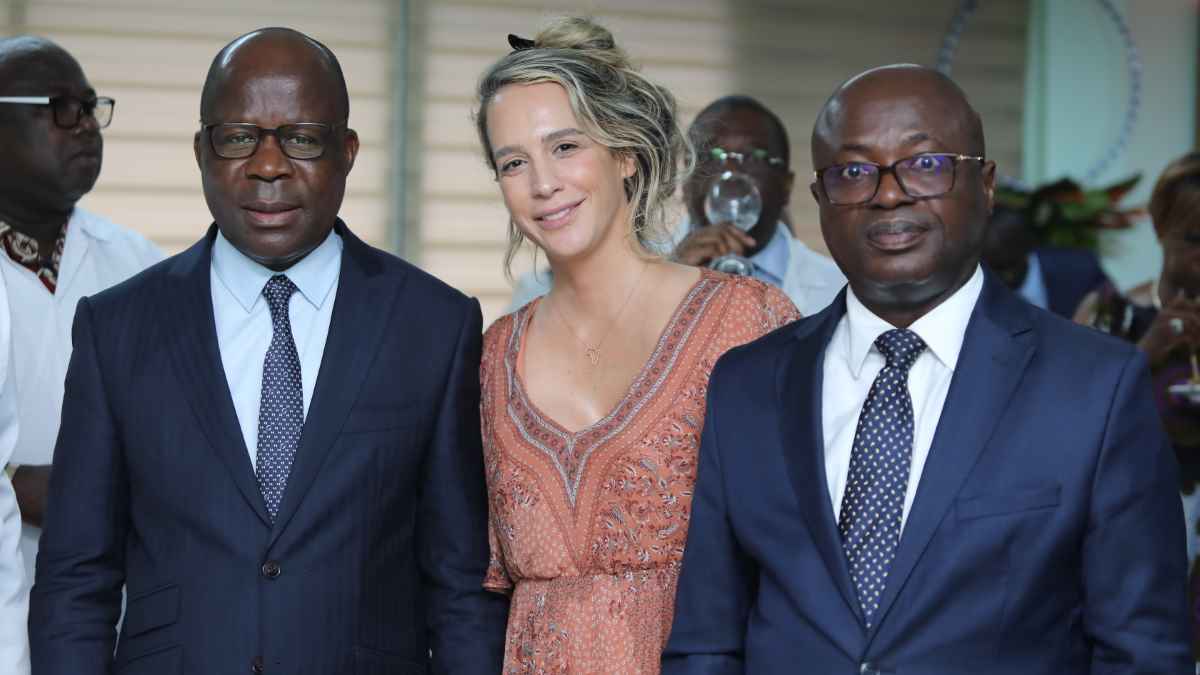

Eva Peled, Mitrelli’s Partner in Côte d’Ivoire stated: “We have been working with the government of Côte d’Ivoire and its ministry of health for several years. We discovered a wonderful country with many hidden gems, among which is the Abidjan Institute of Cardiology (ICA). The ambitious vision of His Excellency Alassane Ouattara, President of Côte d’Ivoire, has made the health sector a priority for the nation’s citizens. Under the leadership of Prime Minister Patrick Achi and the guidance of the Minister of Health Pierre Dimba, we are honored and proud to join forces in this humane initiative, which reflects our shared beliefs and values. We believe that Côte d’Ivoire will not only become a point of reference for cardiac surgeries, but for many other sectors in Africa.”

Professor Mohamed Ly, cardiac surgeon, and President of the AFCOA, added: “This extraordinary partnership signifies a monumental step towards providing essential surgical care and empowering local teams, ensuring a brighter future for children who currently lack access to these critical services.”

Simon Fisher, Executive Director of Save a Child’s Heart: “We are very grateful to the Mitrelli Group and the Menomadin Foundation for their partnership and for initiating the expansion to Cote d’Ivoire of Save a Child’s Heart activities.

The arrival of the group of nine children in Israel for lifesaving treatment at the Sylvan Adams Children’s Hospital is a major step in the implementation of this strategic initiative in partnership with the Côte d’Ivoire Health Ministry and the Institut de Cardiologie d’Abidjan. This group of children, and future groups to be treated in Israel, will complement the capacity building efforts in Côte d’Ivoire led by the Association Française du Coeur pour l’Afrique de l’Ouest (AFCAO) and the Centre Hospitalier Universitaire (CHU) de Nantes from France turning this initiative into an truly international project that will lead to Côte d’Ivoire to becoming self-sustainable in Paediatric Cardiac Care and a Regional leader in the field.”

Distributed by APO Group on behalf of Mitrelli Group.

Business4 days ago

Business4 days ago

Business3 days ago

Business3 days ago

Business4 days ago

Business4 days ago

Events3 days ago

Events3 days ago

Business4 days ago

Business4 days ago

Energy3 days ago

Energy3 days ago

Energy2 days ago

Energy2 days ago

Business4 days ago

Business4 days ago