The Under-Secretary who visited the Bank’s Abidjan headquarters on 12 September, held meetings with the Bank’s Executive Director for Argentina, Austria, Brazil, Japan and Saudi Arabia, Takaaki Nomoto, as well as senior Bank executives

ABIDJAN, Ivory Coast, September 18, 2023/APO Group/ —

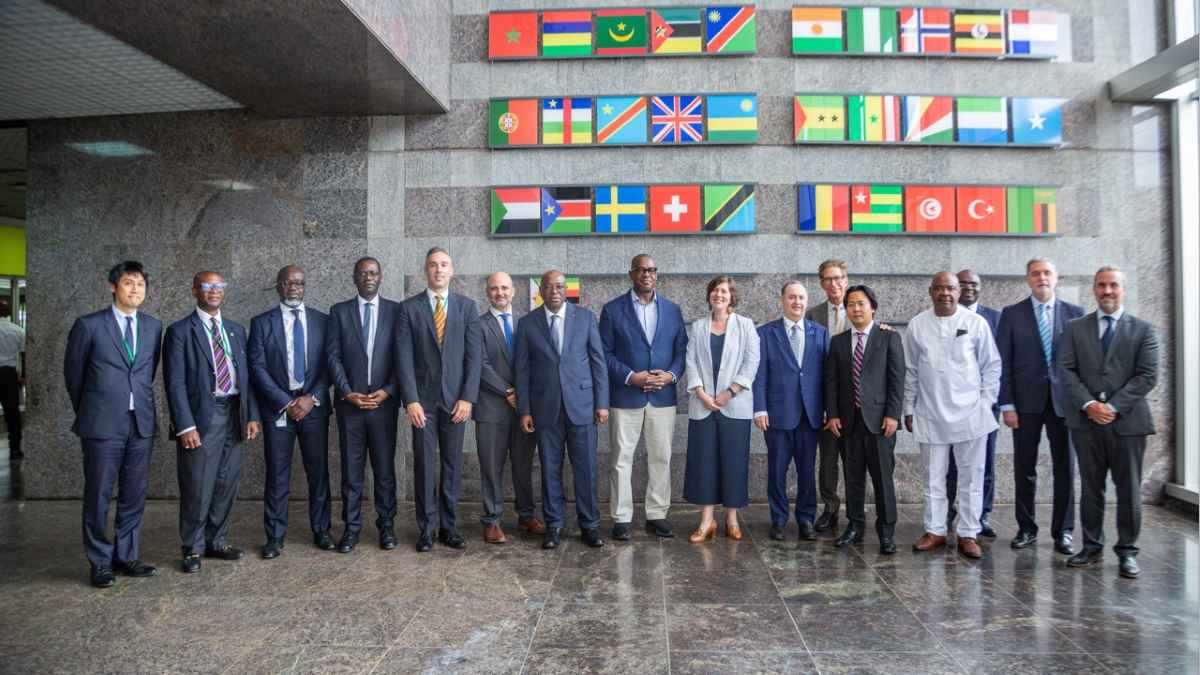

On a visit to the African Development Bank (http://www.AfDB.org), Argentina’s Under-Secretary for Foreign Policy Claudio Rozencwaig has expressed keen interest in deepening the existing partnership and exploring opportunities that benefit Argentinean and African businesses, notably in agriculture and pharmaceuticals.

The Under-Secretary who visited the Bank’s Abidjan headquarters on 12 September, held meetings with the Bank’s Executive Director for Argentina, Austria, Brazil, Japan and Saudi Arabia, Takaaki Nomoto, as well as senior Bank executives. He was accompanied by Argentina’s ambassador to Nigeria, Alejandro Herrero.

African Development Bank Vice president for Technology and Corporate Services Simon Mizrahi, welcomed the visitors. Vice President for Private Sector, Infrastructure & Industrialisation, Solomon Quaynor and Alex Mubiru, Director General in the Office of Bank head Dr. Akinwumi Adesina also participated in the meeting, as did several managers from across the Bank’s complexes.

Rozencwaig said Argentina has much to offer in the agriculture sector, particularly in livestock production, machinery and techniques for minimising post-harvest losses. He said his country also had capability in satellite imaging for research and transport, as well as animal pharmaceuticals.

The government had experience of participating in “triangular cooperation” agreements with donors, including the Japan International Cooperation Agency and the Islamic Development Bank. Under these arrangements, Argentina provided technical assistance and expertise, he said. Rozencwaig also expressed an interest in learning more about the Bank’s procurement processes.

Quaynor noted that Argentina’s agricultural expertise was of particular interest to the Bank. He stressed the importance of the agriculture sector to the African Development Bank’s strategic plans, including its Feed Africa High-5 priority (https://apo-opa.info/3OiFCJL).

“Synergies between the Bank’s regional member countries and the South American country extended beyond trade. For example, post-harvest losses were as much as 40% in some African countries, Quaynor said, an issue the Bank was working to overcome. He also cited Botswana as an African country that might welcome partnerships with Argentinean beef producers.

Quaynor said the Africa Investment Forum (www.AfricaInvestmentForum.com/) Market Days, scheduled for 8-10 November, represented a great entry point for Argentinean companies looking to invest in Africa.

Argentina became a member of the African Development Fund in 1979 and the African Development Bank in 1985

Damian Ihedioha, Division Manager for Agribusiness, said the Food and Agriculture Delivery Compacts produced during the Dakar Food Summit (https://apo-opa.info/3pcmbZA) were another potential entry point for Argentinean businesses. Ihedioha said the compacts would attract investment in raising agricultural productivity and building out climate smart agricultural systems along the food value chain. He named aquaculture and the blue economy as another area of convergence.

African Development Bank Acting Director for Agricultural Finance Richard Ofori-Mante said the Bank was working to support development of Special Agro-industrial Processing Zones and that these need would require agricultural machinery. He said satellite technology offered a way to assess the quality of soil to boost productivity.

Another avenue for partnership and engagement that came up in the conversation is the Bank’s South-south cooperation Trust fund, which was established under Brazil to support African countries in mobilising and taking advantage of development solutions and technical expertise available in the South.

Eduardo Rolim de Pontes Vieira, Senior Advisor to Executive Director Nomoto, said although the fund had been established in partnership with Brazil, it was being reconstituted as a multi stakeholder trust fund, a move that would enable Argentina to become a donor.

Discussions also covered attracting more Argentinean professionals to the African Development Bank, potentially through its Young Professionals programme, with Mubiru suggesting a recruitment seminar in the country.

Argentina became a member of the African Development Fund in 1979 and the African Development Bank in 1985. The country pledged $15 million to the African Development Fund’s 12th replenishment.

Other topics discussed included the Bank’s Business Opportunity Seminars, held twice each year, as a means to learn more about African Development Bank procurement processes. The next seminar is scheduled for October 2023.

The visit took place as Argentina is seeking to expand its footprint across Africa. The country has opened embassies in Mozambique and Angola in recent years and is mulling re-opening an embassy in Côte d’Ivoire.

Distributed by APO Group on behalf of African Development Bank Group (AfDB).

Business3 days ago

Business3 days ago

Energy4 days ago

Energy4 days ago

Business4 days ago

Business4 days ago

Energy2 days ago

Energy2 days ago

Business4 days ago

Business4 days ago

Business4 days ago

Business4 days ago

Energy3 days ago

Energy3 days ago

Energy3 days ago

Energy3 days ago