Collaboration between SACE and the African Development Bank Group to sustain the development of initiatives with Africa’s public and private sectors, with additional opportunities for Italian businesses in education, agribusiness, healthcare, energy, water and infrastructure

RABAT, Morocco, December 6, 2024/APO Group/ —

SACE, the Italian insurance-financial group specializing in supporting businesses and the national economic system under the Ministry of Economy and Finance, and the African Development Bank Group (www.AfDB.org), today signed a collaboration agreement to provide credit protection to foster investment in Africa, under the “Mattei Plan”.

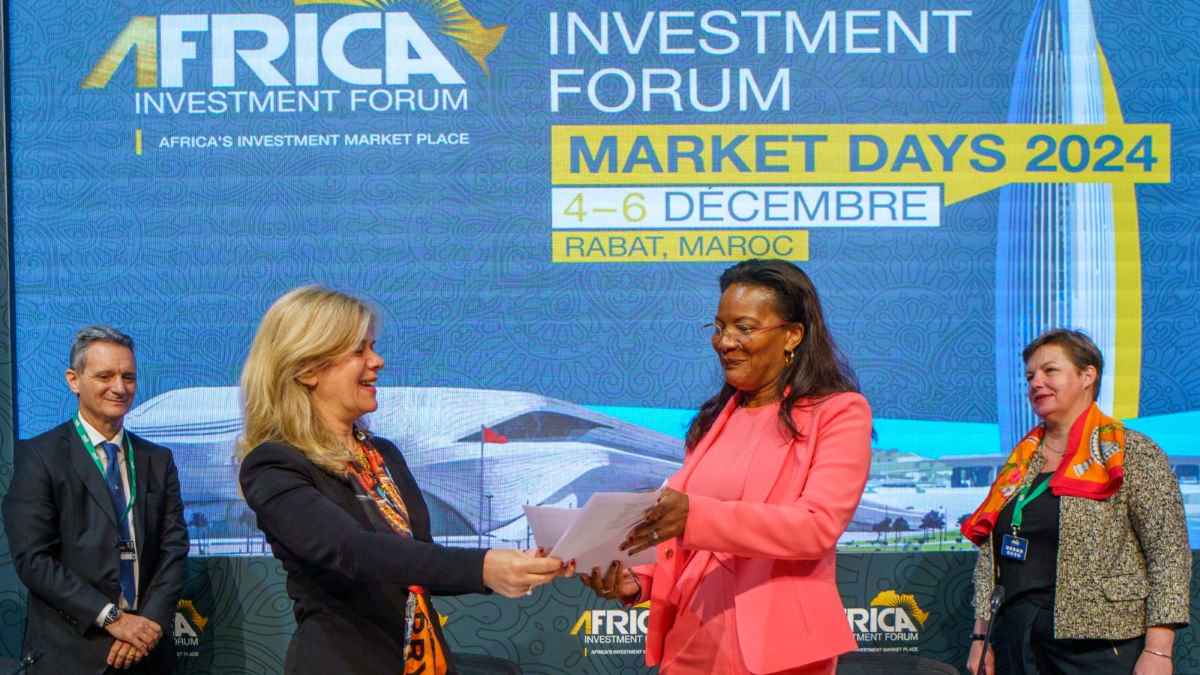

The signing took place during the African Investment Forum 2024 Market Days currently underway in Rabat, Morocco.

The collaboration agreement, signed by Michal Ron, Chief International Business Officer of SACE, responsible for the Overseas Network and African Development Bank Vice President for Finance and Chief Financial Officer Hassatou N’Sele, was conceptualized under the “Mattei Plan” Task Force at the Italian Prime Minister’s Office.

The $6 billion Mattei plan to bolster economic links and create an energy hub for Europe, while curbing African emigration to Europe, was unveiled by Italian Prime Minister Georgia Meloni in February this year. The Italian Government and the African Development Bank Group have planned a series of joint initiatives to support the implementation of the Mattei Plan.

Through collaborations like the ‘Mattei Plan’, in partnership with SACE, we aim to unlock these opportunities and ensure that Africa’s vast potential is fully realized

This initiative establishes synergies between SACE’s products, such as the Push Strategy as an untied export credit product, traditional export credit insurance, and the financial products offered by the African Development Bank Group. It will support the financing of high impact projects in Africa, while jointly generating opportunities for business matching between African and Italian companies.

“Africa represents a market of great potential for our companies, and our collaboration under the “Mattei Plan” will strengthen their positioning in key sectors for the continent’s development, in line with the purpose of the Mattei Plan,” said Ron. “In particular, we are already identifying new business opportunities where SACE can make a difference thanks to the Push Strategy, a financial instrument that, through guarantees, connects African buyers with Italian SMEs, involving them in strategic projects related to infrastructure, agribusiness, healthcare, energy, and education: priority sectors where Made in Italy, with SACE’s support, can offer a significant contribution.”

It aims to develop commercial relations between Italy and Africa, encouraging the business of Italian companies interested in operating on the continent in priority sectors of the Mattei Plan: education and training, agriculture/agro-industry, healthcare, energy, water, infrastructure, including digital economy infrastructure. All African Development Bank regional member countries will be eligible, although initially priority will be given to the countries identified in the Mattei Plan: Algeria, the Republic of Congo, Egypt, Ethiopia, Ivory Coast, Kenya, Morocco, Mozambique, and Tunisia.

Potential African buyers will be invited to participate in Business Matching events organized by SACE, involving Italian counterparts, to foster collaboration and strengthen the Italy-Africa partnership.

N’Sele noted: “While there is often a perceived risk in investing in the continent, the reality is that Africa offers a wealth of opportunities with actual risk lower than the perception, particularly in key sectors such as education, agribusiness, healthcare, energy, and infrastructure.” She added: “The African Development Bank Group is committed to deepening our partnerships with institutions like SACE to expand financing and de-risking solutions for critical projects across Africa. Through collaborations like the ‘Mattei Plan’, in partnership with SACE, we aim to unlock these opportunities and ensure that Africa’s vast potential is fully realized.”

The Africa Investment Forum (www.AfricaInvestmentForum.com) is a multi-stakeholder, multi-disciplinary platform that advances projects to bankable stages, raises capital, and accelerates deals to financial closure. Its vision is to channel capital towards critical sectors to achieve the Sustainable Development Goals, the African Development Bank’s High 5s (http://apo-opa.co/49nJdPO) and the African Union’s Agenda 2063 (http://apo-opa.co/49nJemQ).

Distributed by APO Group on behalf of African Development Bank Group (AfDB).