Partech Africa, the VC fund dedicated to technology startups in Africa, has issued its annual report on Africa Tech Venture Capital

DAKAR, Senegal, January 24, 2023/APO Group/ —

Amid the drastic pullback in global VC funding, the African tech ecosystem stands out with +8% growth from 2021. Debt funding doubled in volume to $1.5B, accounting for nearly a quarter of the total funding. Fintech, still leading, attracted 39% of the total equity volume; Nigeria retained the top spot with 23%

Partech Africa, the VC fund dedicated to technology startups in Africa, has issued its annual report on Africa Tech Venture Capital. The report, which aims to provide a practical picture of the state of the ecosystem, revealed that despite the global VC downturn, the African tech ecosystem grew faster than all other markets globally.

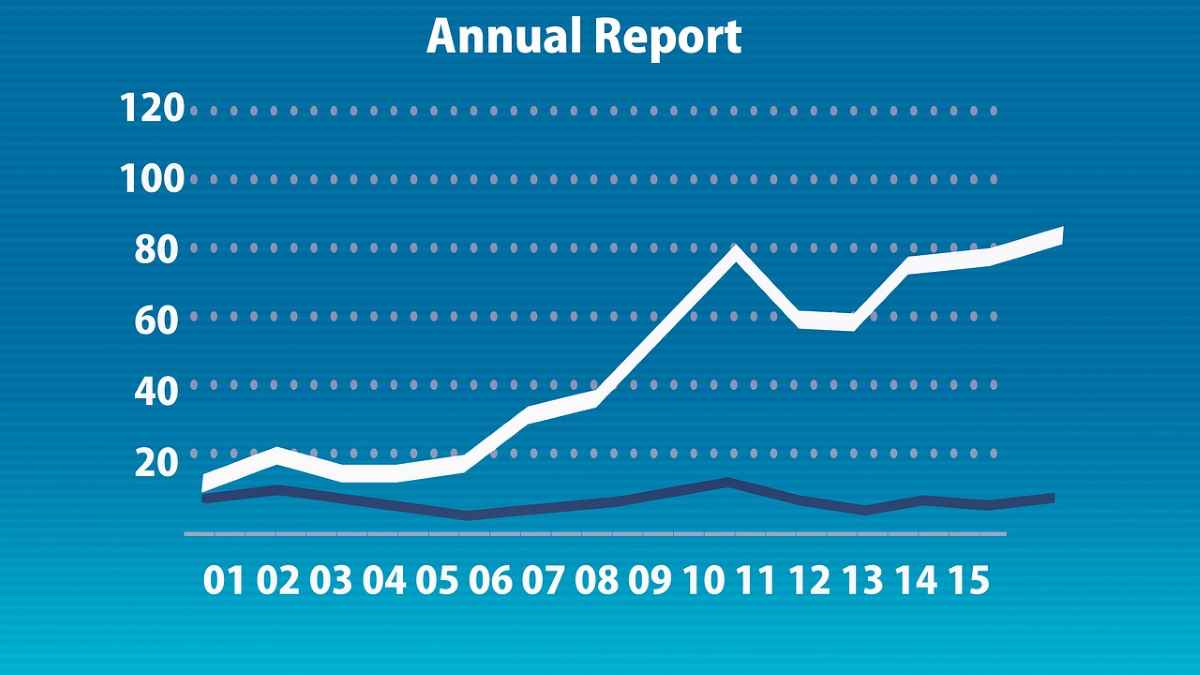

Total funding invested into tech startups on the continent reached $6.5B, an increase of 8% vs 2021, spread across 764 deals – compared to 724 rounds in 2021. The report, consisting of disclosed and confidential deals, saw debt funding more than double in volume, reaching $1.55 billion through 71 deals [65% YoY growth]. In comparison, equity rounds showed a slight decline, as 653 African tech startups raised $4.9B [-6%] in 693 equity rounds [2% YoY growth].

Focusing on the equity funding, the report revealed the ecosystem was still accelerating during Q1 and Q2 of 2022 compared to 2021, with the YoY comparison showing Q1 and Q2 at +127% YoY and +83% YoY, respectively. However, the global VC slowdown stifled growth in activity in Q3 [-65% YoY] and Q4 [-35% YoY]. In 2022, fundraising activities remained flat across all stages. At $1.4M, Seed+ ticket sizes averaged higher in 2022 [+12% YoY], while Series A remained the same at $8.5M. Later stages reverted to 2019 levels, as Series B and Growth round sizes dropped by -23% and -50% YoY, respectively. In addition, 2022 witnessed a significant reduction in the number of megadeals [over 100M], with only seven deals compared to 14 in 2021.

2022 was a particularly challenging year for the venture ecosystem worldwide, as venture and growth investors scaled back their investment by a third

Speaking on the launch of the annual report, Tidjane Deme, General Partner at Partech, said: “2022 was a particularly challenging year for the venture ecosystem worldwide, as venture and growth investors scaled back their investment by a third. However, by comparison, our report revealed the African tech ecosystem showed great resilience, as more investors have doubled their commitment to the continent by investing in local teams and funds dedicated to the market, which is proving to be the best way forward.”

Overall, Nigeria, South Africa, Egypt and Kenya remain the top investment destinations in Africa, with a share of total volume staying relatively steady at 72%. Nigeria retained the top rank, bringing in $1.2B in capital, despite a decline of 36% from 2021; South Africa, Egypt, and Kenya each attracted over $0.7B in funding, with Ghana completing the top 5 with just over $0.2B. Overall, 28 countries attracted equity funding in 2022, 13 of them in Francophone Africa..

In light of the market downturn, the report’s findings also revealed that Fintech, which has historically attracted sizable investments, was the most impacted by the slowdown in the number of large rounds. However, fintech remains the most funded sector in Africa, and this across all sources of capital, with 39% of the total equity volume [$1.9B] and 45% of the total debt volume [$691M]. Other sectors have experienced substantial growth and gained a meaningful share of the equity funding activity this year, most notably Cleantech, which made a big comeback with 18% of total equity funding at $863M [+347% YoY] but also 39% of the total debt funding at $605M.

The report’s findings also show:

- Female-founded startups raised 22% of all equity rounds in 2022, up 2 percentage points from 20% in 2021. They also contributed $644 Million or 13% of the total equity funding, down 3 percentage points from 16% in 2021.

- Outside of the top 4 countries, Ghana ($202 million), Algeria ($150 million), Tunisia ($117 million) and Senegal ($105 million) were the only other countries that broke the $100M funding mark.

- Despite a slowdown in the growth rate of equity investors, Africa’s tech ecosystem attracted 1,149 unique investors for the first time [+29% YoY in 2021]. African tech has seen more investors committed, with 89 participating in 5 or more deals (compared to 65 investors in 2021).

- The number of debt investors active on the continent is growing 2.5x YoY, with a good mix of local debt institutions, international lenders with emerging market vehicles and Development Finance Institutions.

Cyril Collon, General Partner at Partech, added: “Much of our methodology has remained the same over the years, and we, therefore, can provide a snapshot of how the African continent has evolved over the years. Nigerian and the fintech vertical have remained at the top spot; however, in an environment where equity funding is more challenging, debt has proved to be a solid alternative source of African tech startups in 2022, which signals a maturity within each sector.”

Headquartered in Dakar, Partech Africa is the largest VC fund dedicated to technology startups in Africa. With a focus on Late Seed, Series A and B equity rounds in startups which are changing the way technology is used across multiple sectors, including education, mobility, finance and healthcare, the VC has, to date, invested in 17 African startups, such as Wave (http://bit.ly/3J9lGqy) and TradeDepot (http://bit.ly/3R2IgD9). Using the same methodology as previous years, the seventh Partech Africa annual report on African tech start-ups only includes equity rounds where the total amount is higher than US$200K.

To download the full ‘2022 Africa Tech Venture Capital’ report, click here (https://bit.ly/3R5mChF).

Distributed by APO Group on behalf of Partech Partners.