The new round brings LemFi’s total capital raised to $85 million to date

LONDON, United Kingdom, January 14, 2025/APO Group/ —

- LemFi is transforming how immigrant communities access financial services, starting with international remittance and payments to ease financial hurdles

- The platform enables diaspora communities in Europe and North America to move money reliably and affordably to emerging markets, including China, India, Kenya, Nigeria and Pakistan

- Since its launch in 2021, LemFi has grown to over one million customers and recently crossed $1 billion in monthly transaction volume

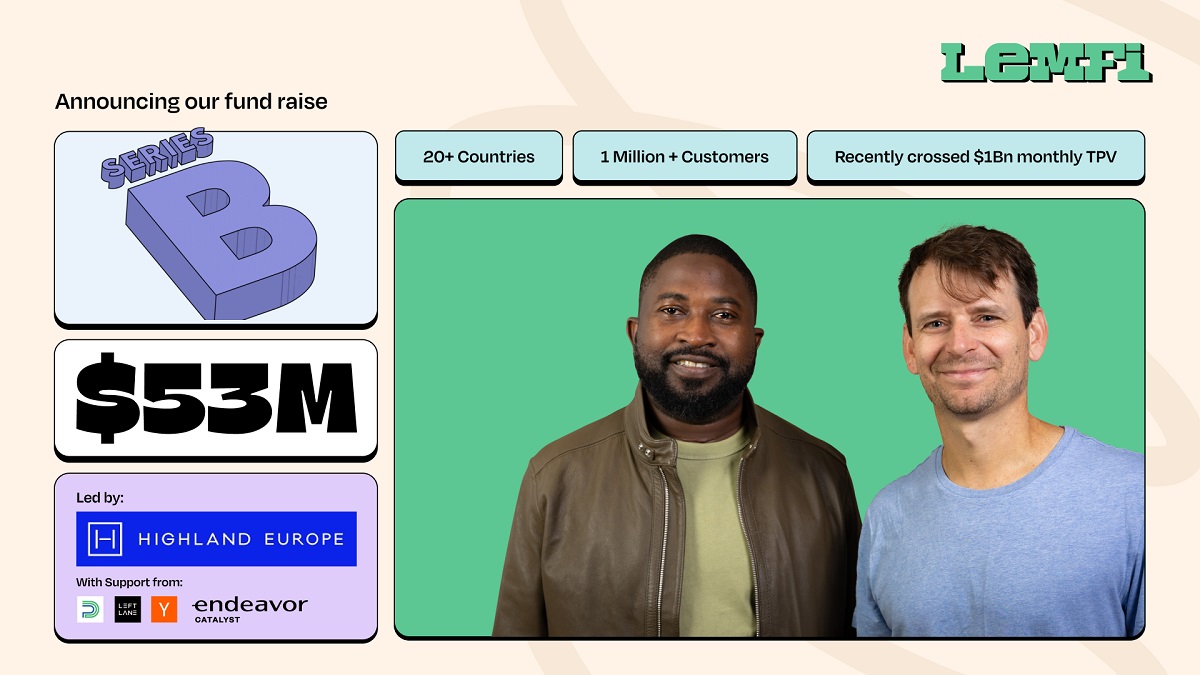

LemFi (www.LemFi.com), the platform transforming how immigrant communities access financial services, has raised $53 million in Series B funding led by Highland Europe with participation from previous investors Left Lane Capital, Palm Drive Capital, Endeavor Catalyst and Y-Combinator. The new round brings LemFi’s total capital raised to $85 million to date.

Founded in 2021, LemFi is building the trusted financial services platform for immigrant communities worldwide. Starting with payments and remittances, LemFi enables users to open multi-currency accounts and send and receive money globally, reliably and at a low cost. With over one million users across Europe and North America sending money to emerging markets, including India, Kenya, Nigeria and Pakistan, LemFi recently crossed $1 billion in monthly transactions. This is set to increase further, with LemFi adding Asia, including China, to its platform, growing 30% month-on-month.

More than remittance

Every year, millions of people relocate abroad to start new lives, and money transfers remain an important financial support mechanism to their home countries. For emerging markets, remittances are an important source of foreign exchange and can exceed foreign direct investment in some cases. In 2023, India alone received $120 billion in remittances (https://apo-opa.co/4af22F6), and the African remittance market is on track to reach $500 billion by 2035 (https://apo-opa.co/4agEXSt). Yet incumbent banks and private agents, which charge high commission rates and take days for transactions to complete, still corner about 60% of the market (https://apo-opa.co/4ajxqlP).

By targeting the communities most in need, we’ve built LemFi into the go-to remittance service for one million people, supporting them in building wealth across 20 countries

LemFi has become the trusted financial partner for diaspora communities in Canada, the UK and the USA, who send money home to 20 countries. After spending four years building trust among its user base, LemFi is now in the perfect position to provide further services and features to build a full-stack financial services hub for immigrants globally.

From payments to transforming financial services

LemFi’s founders Ridwan Olalere (CEO) (https://apo-opa.co/4aegH3B) and Rian Cochran (CFO) (https://apo-opa.co/40uNjCT) met whilst working at fintech unicorn OPay, incubated by Norwegian browser provider Opera. Olalere had previously worked in software development before becoming OPay’s product lead, where he met Cochran, the company’s finance director. After Olalere left for a stint as an Uber Country Manager, the duo combined their experiences across fintech and payments to build LemFi. They now oversee a 300+ strong multicultural team across Europe, North America, Africa and Asia, drawing on their own experiences to make financial services universally accessible.

Using the new funding, LemFi will focus on growing the company in three core areas: building out the platform to extend its financial services offering, scaling its payment network licenses and partnerships to provide hyper-localised service, and hiring talent globally to support its next growth stage.

Ridwan Olalere, co-founder and CEO of LemFi, said: “When we started building LemFi, we were told remittance had already been solved. But for too many people, it is still too slow, cumbersome and expensive with customers telling us that in some instances it was cheaper to send money from the US via Canada than directly to their families back home. By targeting the communities most in need, we’ve built LemFi into the go-to remittance service for one million people, supporting them in building wealth across 20 countries. We’re not stopping there: this new funding will support us in our mission to build the financial services hub for immigrants globally from adding new features to expanding to new countries. We’re delighted to be partnering with Highland to help us scale LemFi into a fintech giant.”

Sam Brooks, Partner at Highland Europe, said: “LemFi’s mission to provide trusted, reliable access to financial services for immigrant communities has inspired an incredibly loyal customer base and has generated impressive growth over the past several years. In addition to the success in initial geographies, we are excited by LemFi’s continuing international expansion given the extent of the global problem they are solving. Ridwan and Rian are fantastic leaders, and we are thrilled to partner with them and the LemFi team to help them scale and continue their growth into new markets.”

Distributed by APO Group on behalf of LemFi.