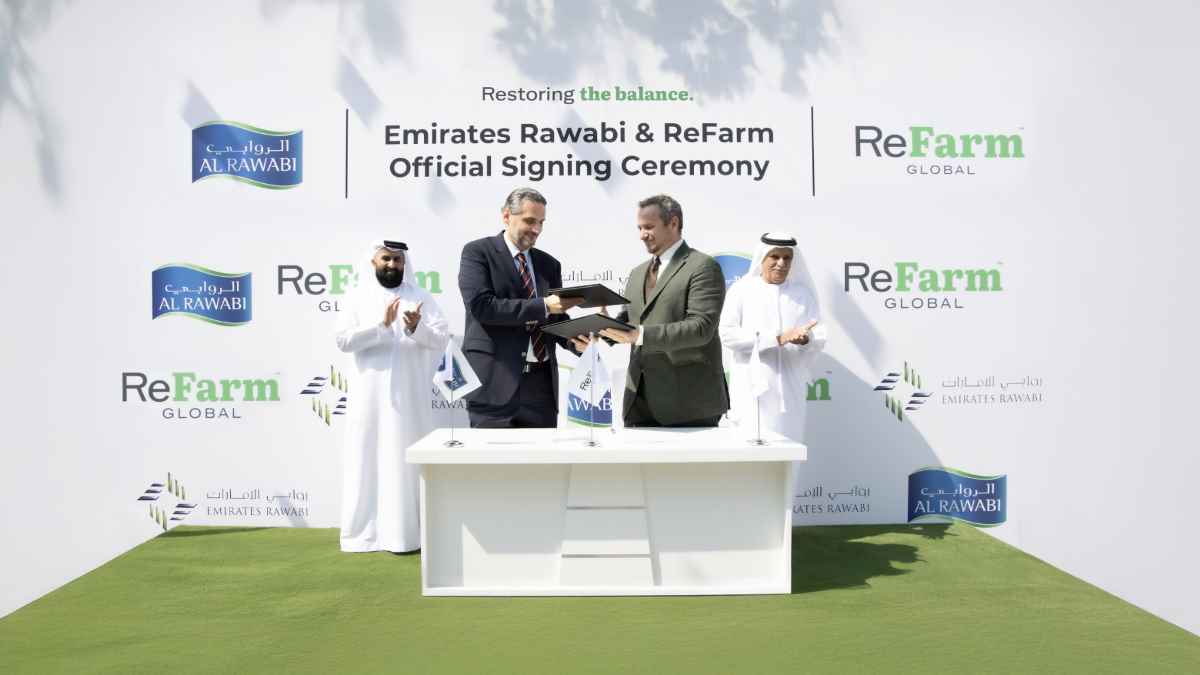

DUBAI, United Arab Emirates, November 11, 2025/APO Group/ –In a landmark step toward transforming the UAE’s agricultural and food production landscape, Emirates Rawabi PSC (

www.EmiratesRawabi.ae), one of the nation’s leading integrated agribusiness groups, has entered into a strategic partnership with ReFarm Global Investments LLC (

https://ReFarmTheWorld.com), a pioneer in regenerative and circular sustainability technologies. This collaboration is set to revolutionize not only the UAE’s food production systems but also

change the landscaping industry, establishing a new benchmark for sustainable urban and agricultural growth across the region.

Together, they will drive a new model of circular agribusiness, creating cost-efficient, carbon-conscious, and regenerative solutions to strengthen food security, enhance soil health, and drastically reduce water use across the UAE’s farming and food production systems. Beyond agriculture, this initiative will also extend its impact to urban environments and landscaped areas, supporting sustainable living and greener communities. In line with the leadership’s vision to make Dubai the most beautiful, advanced, and liveable city in the world, this collaboration will help develop a sustainable master plan for urban greening, improve irrigation efficiency, reduce the urban heat island effect, and enhance the sustainability of Dubai’s parks and green ecosystems. It will redefine the landscaping industry for future developments, promoting eco-efficient design, reduced water consumption, and the creation of resilient green spaces that align with the UAE’s long-term vision for a sustainable and regenerative future.

A partnership for the future of food

This collaboration combines Emirates Rawabi’s extensive expertise in dairy, poultry, feed, and food production with ReFarm’s breakthrough technologies in agricultural waste-to-value systems, regenerative soil enhancement, and air, soil, and water optimization.

The partnership aims to create a sustainable food ecosystem that regenerates rather than depletes, by improving soil vitality, optimizing resources, and ensuring food production that is both economically and environmentally efficient.

“Our mission is to restore the balance between nature, technology, and progress,” said Oliver Christof, CEO of ReFarm Global Investments LLC. “Through this collaboration, we will empower farmers, urban developers, and food producers with innovative and cost-efficient systems that strengthen food security, while preserving our most valuable resources like air, soil and water.”

Through this collaboration, we will empower farmers, urban developers, and food producers with innovative and cost-efficient systems that strengthen food security

“We share a common vision to make the UAE a global leader in regenerative and circular agriculture. Our technologies help farmers grow healthier crops with less water, improve soil quality, and create a new balance between productivity and preservation,” he added.

Sustainable farming solutions from soil to plate

“This partnership marks a key milestone in our sustainability journey. At Emirates Rawabi, sustainability is at the core of everything we do. Through Emirates Rawabi Sustainable Solutions (ERSS), we operate a circular model integrating biogas, solar energy, and advanced water treatment, making our operations responsible, efficient, and resilient. We understand our responsibilities to the environment and also to our communities,” stated Mazen Al Refae, Group CEO of Emirates Rawabi PSC.

“Together with ReFarm, we are implementing practical, scalable solutions that redefine sustainable farming from soil to plate and raise the standard for sustainable farming, strengthen circularity, and deliver measurable environmental impact.”

Through this partnership, Emirates Rawabi and ReFarm Global Investments will develop and implement pilot projects across the UAE that showcase circular agriculture in action from waste valorization to regenerative soil and water systems. The initiative supports the UAE’s national goals for food security, climate action, and sustainable development, positioning the country as a global example of how innovation can create a thriving, low-carbon organic agricultural future.