DAKAR, Senegal, September 4, 2025/APO Group/ –APO Group (

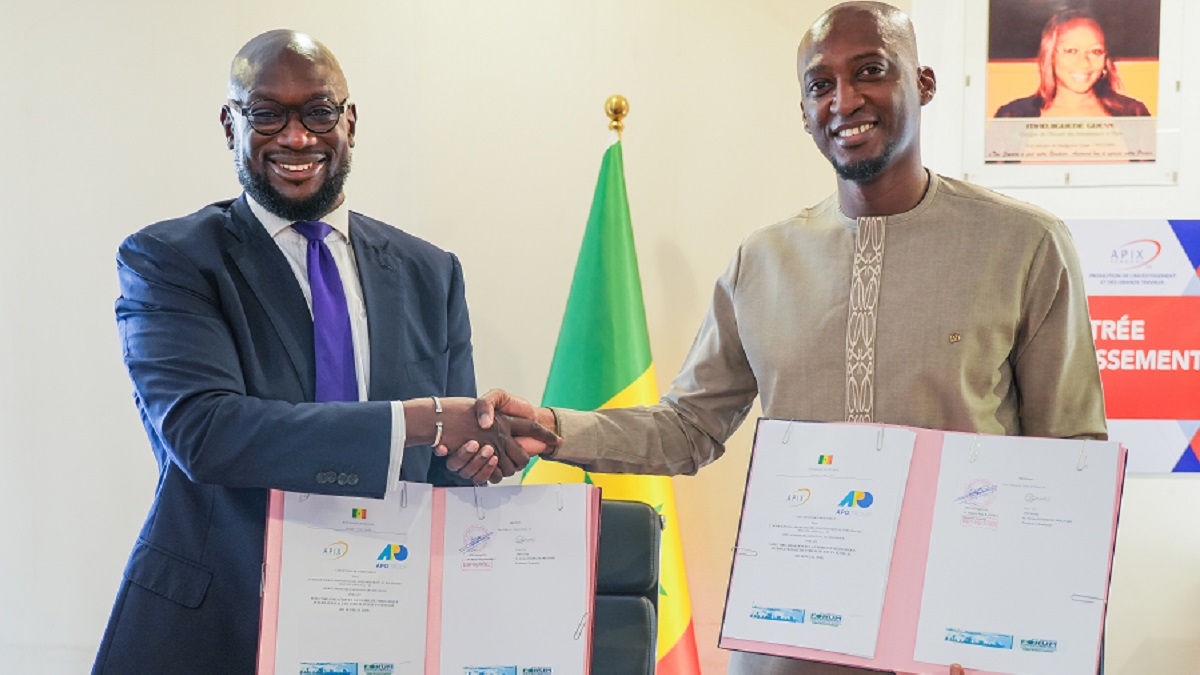

www.APO-opa.com), the leading, multi-award-winning and leading pan-African communications consultancy and press release distribution service, and APIX Senegal S.A., the national agency for the promotion of investment and major infrastructure projects, have entered into a strategic partnership to support the international visibility and promotion of the 2

nd edition of the Forum Invest In Senegal named Fii Senegal 2025.

This collaboration marks a significant step in positioning Senegal as a leading global destination for investment and a model of stability and economic progress in Africa. Under the leadership of His Excellency, President Bassirou Diomaye Diakhar Faye, Senegal is implementing wide-ranging reforms and development policies aligned with Vision Sénégal 2050. These efforts aim to promote inclusive and sustainable growth while strengthening the country’s role as a regional and international trade and investment hub.

Fii Senegal 2025, scheduled for 7 – 8 October 2025 at CICAD in Diamniadio, will convene national and international investors, financial institutions, policymakers, and business leaders to explore investment opportunities, build partnerships, and reinforce Senegal’s ambition to become a continental and global investment hub.

Under the terms of the agreement, APO Group has been chosen as the exclusive pan-African public relations and communications partner for Fii Senegal 2025. In this role, APO Group will be responsible for developing and executing a comprehensive communications strategy aimed at maximising the forum’s visibility across the African continent and on the global stage.

Drawing on its extensive media network, which includes relationships with thousands of journalists and media outlets across all 54 African countries, APO Group will ensure that key messages about Fii Senegal 2025 reach targeted audiences in business, government, finance, and civil society.

Through this collaboration, we aim to ensure that the world looks to Senegal as the priority investment gateway to Africa

In addition to media relations, APO Group will provide strategic counsel on content development, digital engagement, and stakeholder communications to reinforce Senegal’s positioning as a competitive and forward-looking investment destination.

Nicolas Pompigne-Mognard, Founder and Chairman of APO Group, commented, “APO Group is proudly pan-African, with a diverse team and presence across the continent. Supporting African economies is both our mission and our passion. Senegal has the right conditions to become one of Africa’s leading investment destinations, and we are honoured to work with APIX to ensure that Fii Senegal 2025 reaches investors around the world.”

Papa Chimere Diop, Director of Strategic Growth & Market Development at APO Group, added, “As a Senegalese professional working within a pan-African organisation whose mission is to elevate the narrative of our continent, it was only natural for APO Group to partner with APIX in supporting the organisation of Fii Sénégal 2025. Through this collaboration, we aim to ensure that the world looks to Senegal as the priority investment gateway to Africa.”

Mr. Bakary Séga Bathily, Director-General for APIX Sénégal S.A., said, “Fii Senegal 2025 is more than an investment forum – it is a powerful statement of Senegal’s stability, resilience, and forward-looking ambition under the leadership of His Excellency, President Bassirou Diomaye Diakhar Faye. With world-class infrastructure, a skilled and energetic workforce, and our strategic location as the gateway to West Africa, Senegal is open for business and ready to engage with African and global investors. Our partnership with APO Group ensures that Senegal’s story is heard on the African and World stage, reinforcing our commitment to building an open, competitive, and thriving economy aligned with Vision Sénégal 2050.”

Senegal continues to attract growing interest from foreign investors. The country is recognised for its political stability, strong institutions, and peaceful transitions of power. Its geographic location offers strategic access to West Africa and serves as a bridge between Africa, Europe, the Americas, and the Middle East. The government has introduced a series of reforms to improve the investment climate, including incentives, regulatory transparency, and business-friendly policies. The country’s economy has consistently outperformed regional averages in GDP growth and is undergoing transformation through major infrastructure investments in ports, airports, industrial zones, highways, and energy facilities, enhancing its competitiveness as a logistics and business centre.

In addition to infrastructure, Senegal presents strong opportunities across key sectors such as oil and gas, renewable energy, agribusiness, ICT, tourism, and services. As a member of ECOWAS, UEMOA, and the African Continental Free Trade Area (AfCFTA), Senegal offers access to a regional market of over 400 million consumers, further strengthening its appeal. These factors have already attracted major multinational corporations and development finance institutions, reinforcing investor confidence in Senegal’s long-term economic outlook.

The partnership between APO Group and APIX S.A. reflects a shared commitment to promoting Senegal’s economic progress and enhancing Africa’s presence in the global investment landscape.