ABIDJAN, Ivory Coast, February 17, 2025/APO Group/ —

- Growth rates above 5 percent expected in close to half of the continent’s countries in 2025; 12 of world’s 20 fastest growing economies will be African

Africa’s economic performance is showing signs of improvement but remains vulnerable to global shocks, according to the 2025 Macroeconomic Performance and Outlook (MEO) report released by the African Development Bank (www.AfDB.org/en) on Friday.

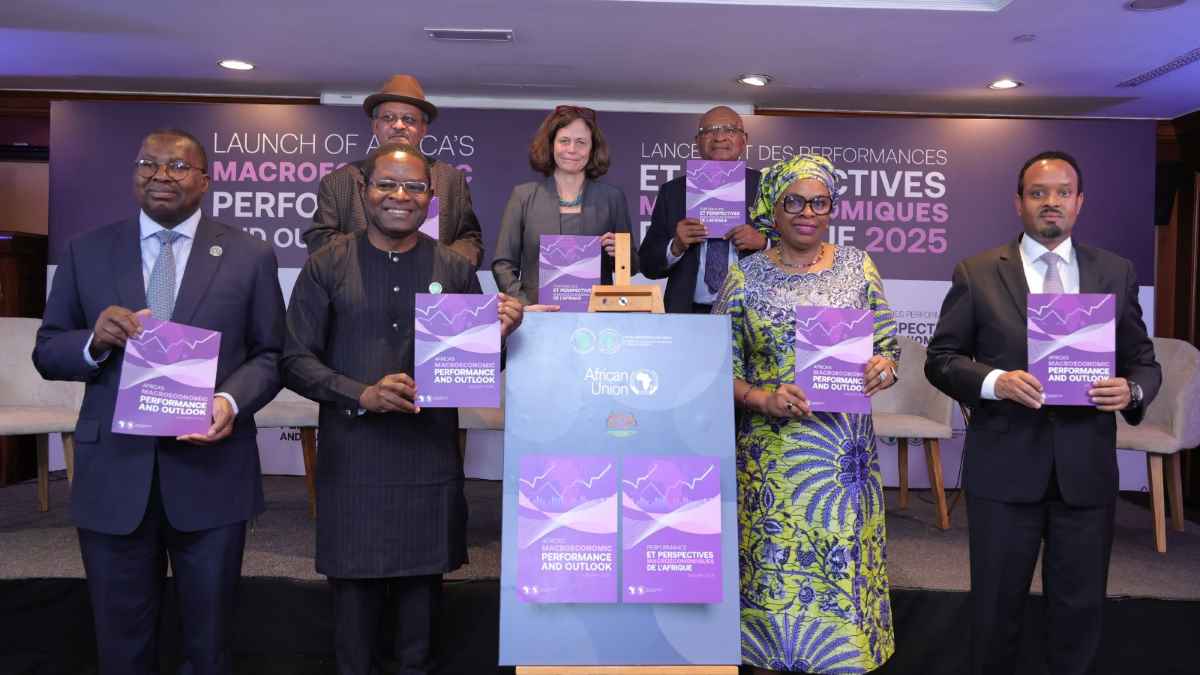

The report, unveiled on the sidelines of the 38th Ordinary Session of the African Union Assembly in Addis Ababa, projects real GDP growth to accelerate to 4.1 percent in 2025 and 4.4 percent in 2026. The forecast is attributed to economic reforms, declining inflation, and improved fiscal and debt positions.

Despite the positive trajectory, the report highlights that Africa’s growth remains below the 7 percent threshold required for substantial poverty reduction. The continent also continues to grapple with geopolitical tensions, structural weaknesses, climate-related disasters, and prolonged conflicts in regions such as the Sahel and the Horn of Africa. It estimated Africa’s average real GDP growth to be 3.2 percent in 2024, slightly higher than the 3.0 percent recorded in 2023.

The report notes that while inflationary pressures persist, Africa’s average inflation rate is expected to decline from 18.6 percent in 2024 to 12.6 percent in 2025-2026 due to tighter monetary policies. Fiscal deficits have widened slightly from 4.4 percent of GDP in 2023 to 4.6 percent in 2024 but are projected to narrow to 4.1 percent by 2025-2026. Public debt levels have stabilized but remain above pre-pandemic levels, with nine countries in debt distress and eleven at high risk of distress.

The MEO, published by the Bank biannually in the first and fourth quarters, responds to a critical need for timely economic data amid global uncertainty. It serves policymakers, development partners, global investors, researchers, and other stakeholders.

The 2025 report identifies 24 African nations, including Djibouti, Niger, Rwanda, Senegal, and South Sudan, as poised to exceed 5 percent GDP growth in 2025. Additionally, Africa remains the world’s second-fastest-growing region after Asia, with 12 of the 20 fastest-growing economies projected to be on the continent.

Ethiopia’s Finance Minister, Ato Ahmed Shide, praised the report’s depth of analysis. “It underscores the fragility of Africa’s economic growth, which is projected to hover around 4 percent in the near term,” he said, emphasizing the need for proactive policy measures to sustain growth and stability.

He said Ethiopia has taken bold steps to restore macroeconomic stability, build resilience, and accelerate growth, with the government prioritizing economic liberalization, private sector empowerment, and fiscal discipline.

As Africa navigates an increasingly complex economic landscape, policymakers must adopt a forward-looking approach to reinforce resilience and drive sustainable growth

Strengthening Africa’s Resilience

In her remarks at the report’s launch, Nnenna Nwabufo, Vice President for Regional Development, Integration, and Business Delivery at the African Development Bank, highlighted the continent’s potential for driving global economic expansion but said achieving this requires decisive and well-coordinated policies.

“As Africa navigates an increasingly complex economic landscape, policymakers must adopt a forward-looking approach to reinforce resilience and drive sustainable growth. Africa’s economic resilience and growth prospects remain strong, but challenges persist,” said Nwabufo, who represented the Bank Group’s President, Dr. Akinwumi Adesina.

Presenting the report, Prof. Kevin Urama, the Bank Group’s Chief Economist and Vice President for Economic Governance & Knowledge Management, underscored the need for stronger coordination between monetary and fiscal policies to manage inflation while fostering economic expansion.

He urged countries to strengthen foreign reserves to shield economies from external shocks and currency depreciations, alongside pre-emptive debt restructuring to prevent defaults and enhance financial stability.

Medium- to long-term strategies should include increasing investments in integrated infrastructure to drive economic transformation and diversification. Governments must work to enhance the business environment through regulatory reforms and long-term strategies to attract private investment, Urama said.

The 2025 MEO report outlines key policy recommendations, including implementing pre-emptive debt restructuring to enhance financial stability, investing in integrated infrastructure to support economic diversification and improving the business environment through regulatory reforms and investment strategies.

Path Forward

Panel discussions following the report’s launch underscored the importance of fully implementing continental development initiatives such as the African Continental Free Trade Area agreement. Discussions also focused on accelerating new initiatives like the proposed Africa Credit Rating Agency and the African Financial Stability Mechanism.

The panel, moderated by Dr Victor Oladokun, Senior Advisor (Communications and Stakeholder Engagement) to the Bank Group President, included contributions from the African Risk Capacity Group, represented by its chair, Dr. Mothae Maruping. Gambian Finance Minister Seedy Keita highlighted the African Development Bank’s support in implementing the country’s fiscal reforms and domestic revenue mobilization.

African Union Trade Commissioner Albert Muchanga called on the private sector to do more to support the African Continental Free Trade Area, including through increased investments in logistics and manufacturing. “What I would expect [African businesses] to do is come up with logistics centers and warehouses across Africa; I would also expect the African private sector to start planning to develop an African shipping line… We are sitting on potential; the business sector has not responded,” Muchanga said.

Click here (https://apo-opa.co/3CYp6fd) for the 2025 MEO report.