The loan comes under the Enhanced Private Sector Assistance (EPSA) initiative, which is a component of Japan’s Official Development Assistance to Africa

TOKYO, Japan, April 26, 2023/APO Group/ —

The African Development Bank (www.AfDB.org) and the Japan International Cooperation Agency (JICA) signed a JPY 44,100,000,000 ($350 million) loan to finance the Bank’s support for private sector operations in Africa.

The loan comes under the Enhanced Private Sector Assistance (EPSA) initiative, which is a component of Japan’s Official Development Assistance to Africa. The fifth version of EPSA, for an amount of $4 billion, was signed by the Bank and JICA at the Eighth Tokyo International Conference on African Development (TICAD 8), held in Tunis last August.

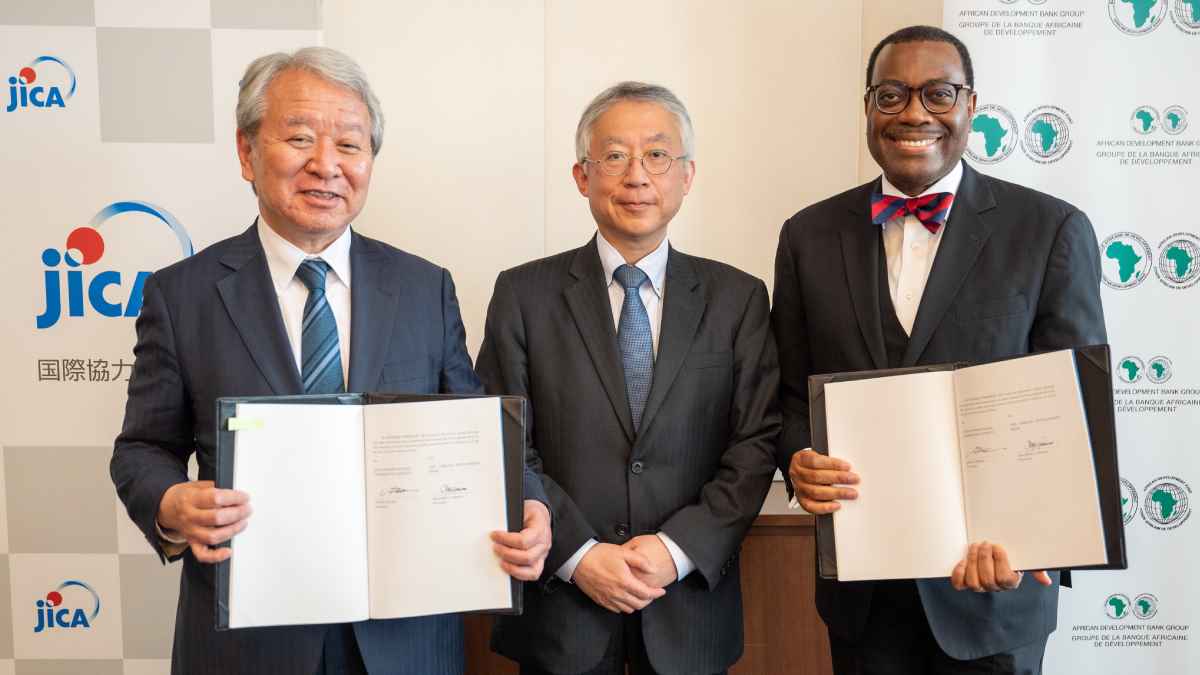

The signing ceremony for the private sector concessional loan took place at JICA’s headquarters in Tokyo, between JICA President, Dr. Tanaka Akihiko and Dr Akinwumi Adesina, President of the African Development Bank Group. Dr Adesina is in Japan to discuss investment opportunities in Africa with senior government officials, large Japanese companies, development partners, parliamentarians and the African diplomatic corps.

Dr Tanaka said the loan represented a crucial step in Japan’s efforts to work with the African Development Bank to support Africa as it faces the challenge of navigating multiple compounded crises including issues of debt sustainability and the impact of the war in Ukraine.

He said: “the private sector in Africa is fundamental in creating jobs for the prosperity and progress of Africa. Although the private sector has been confronting unprecedented economic and social pressures, we are confident that the Bank’s Non-sovereign Operations supported through this concessional loan will play an essential role in addressing these pressing issues.”

Dr. Adesina thanked the government of Japan as well as JICA, for their continued support to the Bank and Africa.

He invited JICA to collaborate with the African Development Bank Group in other critical areas, such as refining the food and agriculture delivery compacts developed by African countries during a January food summit held in Senegal to tackle the continent’s food insecurity.

The private sector in Africa is fundamental in creating jobs for the prosperity and progress of Africa

“JICA’s support would be crucial in the implementation of the Special Agro-processing Industrial Zones, which will be the biggest game changer of Africa’s agriculture. It will transform rural economies, reduce food loses, process and add value to crops produced in rural areas and create jobs,” Adesina added.

“Support young people to go into agriculture. Youth are Africa’s best asset, but they lack access to finance. The Bank is establishing youth entrepreneurship investment banks to provide young people with financial and technical support throughout the business cycle,” Adesina urged.

Dr Tanaka agreed with the areas highlighted by the African Development Bank chief saying they were important to Japan’s agenda of future collaboration with Africa.

On the need to create jobs for young people the JICA president said: “It is silly not to take advantage of active youth in Africa. In Africa you have abundance of youth but in Japan we have abundance of an old population.”

Dr. Tanaka said it was important to explore ways of promoting interaction between Japan’s university students and those of Africa to foster exchange of knowledge and skills. He agreed that JICA should hold further discussions with the African Development Bank Group to look into other issues raised by Adesina, including digitization of primary healthcare operations, and the establishment of the African Pharmaceutical Technology Foundation to be hosted in Rwanda’s capital, Kigali.

JICA and the African Development Bank signed the first private sector assistance loan in 2007. To date, the Bank and the government of Japan have signed eight non-sovereign loans totaling $1.85 billion. The loans have so far contributed to support 51 projects, mainly credit lines and equity to regional development finance institutions, private equity funds and project finance for infrastructure public-private partnerships.

Japan’s support to Africa channeled via the African Development Bank Group through EPSA, consists of three main components: a robust co-financing facility under the Accelerated Co-financing Framework Agreement; the Fund for African Private Sector Assistance, that has been critical in supplying technical assistance and expertise to project sponsors across Africa in various sectors, and the Private Sector Investment Finance.

The government of Japan is one of the Bank’s biggest supporters. It contributed to the Bank’s largest ever General Capital Increase in 2019. In December 2022 Japan provided $534 million to the African Development Fund’s $8.9 billion sixteenth replenishment.

Distributed by APO Group on behalf of African Development Bank Group (AfDB).