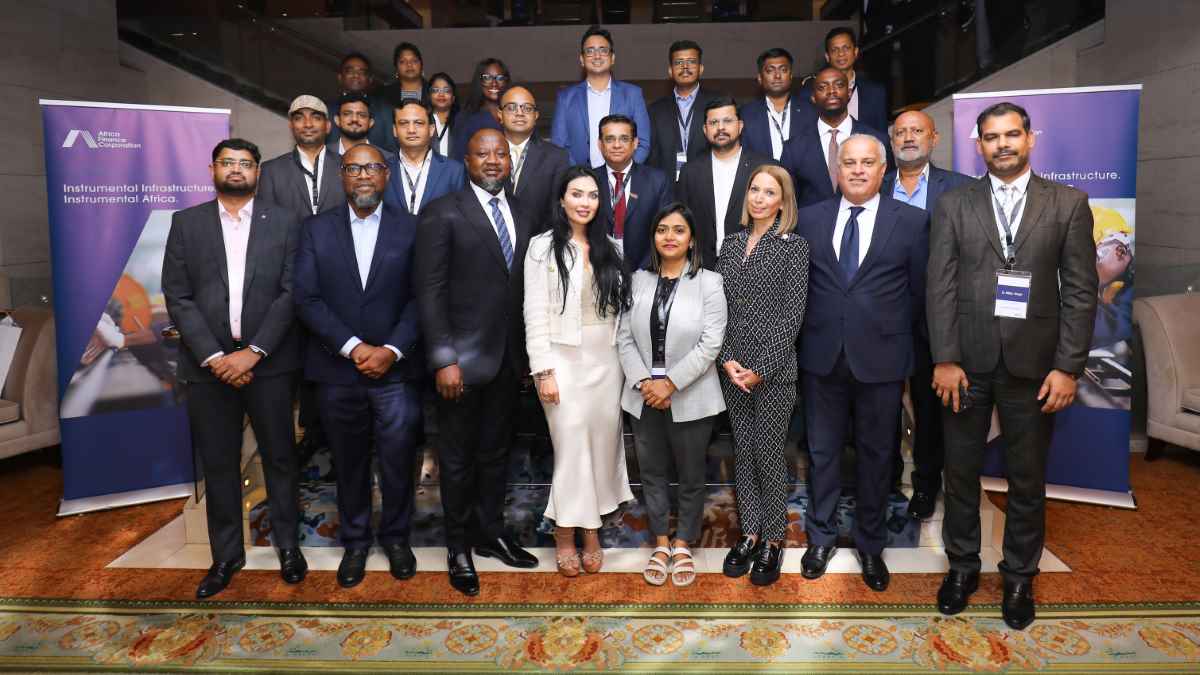

This landmark transaction, commemorated in Dubai, underscores AFC’s robust standing as an investment-grade rated development financial institution with a unique ability to attract diverse global investors

DUBAI, United Arab Emirates, November 18, 2024/APO Group/ —

Africa Finance Corporation (AFC) (www.AfricaFC.org), the continent’s leading infrastructure solutions provider, has successfully closed a US$300 million India-focused syndicated loan, marking a significant milestone in its ongoing strategy to diversify its international investor base. The transaction introduced a new group of lenders from India, further expanding AFC’s global partnerships.

This landmark transaction, commemorated in Dubai, underscores AFC’s robust standing as an investment-grade rated development financial institution with a unique ability to attract diverse global investors, furthering its pivotal mission to catalyse infrastructure development across the continent.

Underlining AFC’s strong position in global capital markets, Bank of Africa UK PLC (BOA UK) acted as the sole mandated lead arranger and bookrunner, assembling a syndicate of seven leading Indian banks. This group included five new lenders—State Bank of India, Canara Bank, Bank of India, Indian Bank, and UCO Bank—alongside two returning lenders, SBI (Mauritius) and Indian Overseas Bank. The lender group behind the transaction reinforces AFC’s strategy of diversifying institutional partnerships and its pivotal role in advancing Africa’s economic growth and industrialisation.

This latest transaction which was oversubscribed by 50% builds on AFC’s fundraising momentum this year, including a landmark US$1.16 billion debt facility that attracted lenders from the Middle East, Europe and Asia. These transactions reflect the Corporation’s growing capacity to mobilise global capital, supported by its A3 credit rating from Moody’s, reaffirmed recently with a stable outlook, which underscores AFC’s sound creditworthiness, strategic positioning in global capital markets, and enhanced capabilities to finance transformative infrastructure projects across Africa.

Indian lenders are unique in their requirements, and we are glad that we could leverage our expertise and successfully execute this landmark transaction for AFC

“We are very pleased to have achieved this historic milestone with the Indian debt markets,” said Banji Fehintola, Executive Board Member & Head, Financial Services, AFC. “This transaction is a remarkable feat in our efforts to mobilise global capital for development impact. With the backing of our A3 credit rating and proven track record of mobilising capital, we remain committed to delivering high-impact initiatives that unlock Africa’s potential. Through transactions like this, we expand transformative opportunities, foster economic resilience, and pave the way for sustainable growth across the African continent. We are grateful to our lenders for their confidence in our mandate and their support for our development goals.”

Said Adren, Chief Executive Officer, Bank of Africa UK PLC, emphasised the significance of this new chapter in AFC’s fundraising strategy: “We have always believed that there is an appetite for Africa risk in previously unexplored lender geographies like India provided it is presented in the right manner. We hope that this deal paves the way for more capital inflows into Africa.”

“Indian lenders are unique in their requirements, and we are glad that we could leverage our expertise and successfully execute this landmark transaction for AFC,” said Zineb Tamtaoui, General Manager, Bank of Africa SA, DIFC Branch, and Head Middle East & Asia for Bank of Africa.

The funds raised through this syndicated loan will be deployed to support transformative projects that will drive long-term positive change across Africa, further cementing AFC’s leadership in advancing impact development.

Distributed by APO Group on behalf of Africa Finance Corporation (AFC).